TSG, a payments advisory firm, released a service to help merchant acquirers and software vendors optimize pricing for merchants. Dubbed the Embedded Pricing Tool, it can help acquirers and software vendors get pricing right without over- or under-pricing merchants. Pricing data comes from the TSG database in its Acquiring Industry …

Read More »How Dwolla Connect Is Another Step Away From Batch Processing

As account-to-account payments raise their profile in the payments arena, Dwolla Inc. has launched Dwolla Connect to enable businesses to integrate the payments into their apps and connect with existing cash-management systems. One of its chief utilities is enabling a centralized location for payment information. Announced Tuesday, Dwolla Connect provides …

Read More »PayPal Steps Into Stablecoin Territory With Its PayPal USD

Add a stablecoin to the roster of PayPal Holdings Inc.’s financial and payments products. Announced Monday, the PayPal USD will begin rolling out to PayPal accountholders today and in coming weeks. A stablecoin is a form of cryptocurrency pegged to a reserve asset viewed as stable, such as gold or …

Read More »Block’s Revenue Jumps 25% As It Continues Its Upmarket Push

Block Inc., corporate parent of Square and Cash App, posted $5.5 billion in second-quarter revenue, a 25% jump from $4.4 billion in the same quarter a year ago, as the payments provider pushes on with its move to add larger merchants. The midmarket segment now accounts for 40% of its …

Read More »For ISOs And Other Acquirers, Picking a Sponsor Bank Entails Understanding Banks

Independent sales organizations can’t do much without a sponsor bank, also known as an acquiring bank, to get them access to the payment card networks. As with most business endeavors, the complexity of finding a sponsor bank has increased. It’s a challenge that attendees at the 2023 Midwest Acquirers Association …

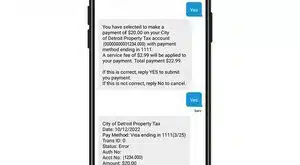

Read More »Eye on Text-to-Pay: DivDat Adds Text-to-Pay for Bill Payments; NMI Adds Authvia’s Text-to-Pay for its Portfolio

Two payments companies are tapping into consumers’ affinity for texting—more than 6 billion SMS text messages are sent daily, according to The Small Business Blog—with a bill-pay service and a program for merchants. First, Detroit-based Diversified Data Processing & Consulting Inc., known as DivDat, added a text-to-pay feature to its …

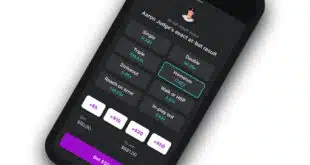

Read More »Two States Are Among the First Paysafe Will Serve Via the Betr Betting App

As online sports betting and iGaming continue to grow, Paysafe Ltd. has struck another deal with a betting app. Announced Monday, its agreement with Betr, a sports-betting app from social-media influencer Jake Paul, will serve Paysafe customers in Ohio and Massachusetts. Betr launched in Ohio in January and in Massachusetts …

Read More »Early 2023 Data Breach Volumes Surpass Most Recent Full Years

As digitalization of payments information continues to permeate society, the allure of getting a hold of that data illicitly is unabated. Already, for the first half of 2023, the number of U.S. data compromises is higher than the total compromises for every full year between 2005 and 2020, except for …

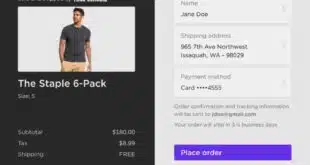

Read More »Shopify’s Latest Sales Channel Is Roku

Entertainment-streaming platform Roku says a partnership with Shopify Inc. will provide viewers the ability to purchase products from Shopify merchants directly from their TV through Roku Action Ads. It works like this: When viewing an ad for a Shopify merchant, viewers press OK on their Roku remote to learn more …

Read More »Spotify Bumps Last Premium Users from Apple Billing

Spotify, the digital-music service, has notified long-time customers it will no longer support payments from Apple Inc.’s App Store for premium subscriptions. Those customers who use the Apple service will be moved to Spotify’s free service and must transition to an alternative, such as PayPal or a credit card, for …

Read More »