Sending cash with birthday cards in the mail is risky, but now Hallmark Cards Inc.’s service with Venmo makes it easier and presumably safer. The new Hallmark + Venmo line of cards includes a QR code inside the card that recipients scan to receive the funds to their Venmo accounts. …

Read More »Grubhub Deploys Amazon’s Just Walk Out Tech on Campus

Students at Loyola University Maryland are the first to use Amazon.com Inc.’s Just Walk Out technology in a Grubhub partnership. The tech enables students, faculty, and staff to shop and walk out with their purchases billed within the app. Funding sources can be a meal plan, account balance, or credit …

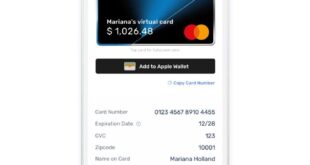

Read More »Eye on Wallets: BMO’s Virtual Card Move; Startup Tezro Deploys a Wallet

Digital wallets continue to find a foothold in payments. The latest entry is BMO Commercial Bank’s debut of Extend, a virtual card service for its app. And startup Tezro launched a digital wallet aimed at integrating banking, payments, and shopping through messaging apps consumers already use. BMO Commercial Bank, a …

Read More »ID Theft Spurs Consumer Security Changes, an ITRC Survey Finds

Most victims of identity theft—53%—began using different passwords across multiple accounts, a move that could reduce their fraud exposure in the future, found a survey from the Identity Theft Resource Center. Typically, though, 59% of consumers use the same password across multiple accounts, the ITRC’s 2023 Consumer Impact Report found. …

Read More »Sephora Is the First Client for J.P. Morgan Payments’ Tap to Pay on iPhone Service

Add Sephora, a beauty retailer, to the list of merchants adopting iPhones as payment-acceptance devices in the Tap to Pay on iPhone program. J.P. Morgan Payments says Sephora is its first such retailer to adopt the contactless-payment service, which does not require special hardware to complete a transaction. Announced Tuesday, …

Read More »The U.K.’s Paysend Eyes U.S. P2P Payments Among Hispanics

Paysend Group is embarking on a campaign to make its name known among U.S. Hispanic peer-to-peer payments users with an advertising campaign and an offer of fee-free money transfers to Latin America, at least initially. Having opened a U.S. office in 2022, London-based Paysend hopes its advertising campaign, which debuts …

Read More »Contactless And Mobile Wallets Are Gaining Ground Among Debit Users, a Pulse Study Finds

Consumer affinity for in-person transactions that reduce points of contact are taking hold as contactless payments made with debit cards swelled to 16% of the U.S. card-present share last year from 8% in 2021. It’s a similar story with debit cards used with mobile wallets. Their use increased from 5% …

Read More »An Embedded Pricing Tool from TSG Aims for Fine Tuning

TSG, a payments advisory firm, released a service to help merchant acquirers and software vendors optimize pricing for merchants. Dubbed the Embedded Pricing Tool, it can help acquirers and software vendors get pricing right without over- or under-pricing merchants. Pricing data comes from the TSG database in its Acquiring Industry …

Read More »How Dwolla Connect Is Another Step Away From Batch Processing

As account-to-account payments raise their profile in the payments arena, Dwolla Inc. has launched Dwolla Connect to enable businesses to integrate the payments into their apps and connect with existing cash-management systems. One of its chief utilities is enabling a centralized location for payment information. Announced Tuesday, Dwolla Connect provides …

Read More »PayPal Steps Into Stablecoin Territory With Its PayPal USD

Add a stablecoin to the roster of PayPal Holdings Inc.’s financial and payments products. Announced Monday, the PayPal USD will begin rolling out to PayPal accountholders today and in coming weeks. A stablecoin is a form of cryptocurrency pegged to a reserve asset viewed as stable, such as gold or …

Read More »