J.P. Morgan Payments sees the future of electronic commerce as one pipeline accessed by consumers across channels. Its role in that scenario is outlined by the debut earlier this year of what it calls a full-stack omnichannel service, one that offers in-store, online, and mobile checkout capabilities. “We realized merchants …

Read More »PSCU/Co-op Debuts a BNPL Service for Credit Unions

Credit union service organization PSCU/Co-op Solutions released its buy now, pay later service to credit unions, enabling their cardholders to make installment payments on their card-based purchases. PSCU/Co-op, which merged Jan. 1, says cardholders whose credit unions enroll in the service can choose qualifying transactions to pay back in installments. …

Read More »A Bad Start to the Year: Ransomware Spikes 130% in January

Already, 2024 is starting off with an unrelenting wave of ransomware attacks. The number of attacks last month, as registered by cybersecurity firm BlackFog, increased 130% from January 2023. Cheyenne, Wyo.-based BlackFog says the 76 attacks noted this January are the second-highest it has ever recorded. The highest number came …

Read More »A New Abrigo Program Enlists AI to Counter Growing Check Fraud

In testing now, the Abrigo Fraud Detection platform is incorporating artificial intelligence into check inspection and image analysis to help banks manage check fraud. Though checks written fell from 15.5 billion in 2018 to 12 billion in 2021, according to the 2022 Federal Reserve Payments Study, they remain a significant …

Read More »Eye on POS: CardFlight Enables Mobile Invoicing; Clover Sport Hits the Ice

Point-of-sale specialist CardFlight Inc. extended the ability to create invoices to its SwipeSimple app, a feature that was previously only available via the Web version. Meanwhile, Fiserv Inc. says the Prudential Center, where the National Hockey League New Jersey Devils play, will adopt Clover Sport point-of-sale hardware and software. New …

Read More »In Chargebacks, Consumers Trust Their Banks, a Chargebacks911 Report Finds

Most U.S. consumers—53%—concerned about a possible fraudulent transaction on their credit card statements make the first inquiry with the issuing bank, not with the merchant. That’s according to the newly released 2024 Cardholder Dispute Index released by Chargebacks911, a Clearwater, Fla.-based dispute-management company. Conducted in partnership with TSG, an Omaha, …

Read More »PayPal Ventures Invests in Mesh Connect—With Its Stablecoin

PayPal Holdings Inc. has put its new stablecoin to work as an investment tool with a PayPal USD investment in Mesh Connect Inc., an embedded-finance platform. Announced Monday, the stake from PayPal Ventures, the digital wallet’s investment arm, was made almost entirely in PayPal USD, a stablecoin PayPal introduced in …

Read More »PayPal Taps Multiple Updates for Its App And Venmo

A new way of shopping using the PayPal app and related services is in the offing. Announced Thursday, the update includes a one-click guest checkout experience, digital receipts PayPal calls Smart Receipts, a revised offers platform, and improvements to business profiles for Venmo, its social peer-to-peer payments service. The moves …

Read More »Mastercard Tags Biometrics And Passkeys as a Fix for Passwords

Mastercard Inc. is taking on the problematic use of passwords with its new Biometric Authentication Service. Announced Wednesday, the new global service is meant to help resolve friction and vulnerability issues that arise from ceaseless passwords and multi-factor authentication prompts, Mastercard says. The service relies on standards from the Fast …

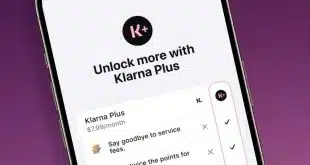

Read More »Eye on BNPL: Klarna Debuts a Subscription Service; PublicSquare Enlists Credova

Klarna AB, a buy now, pay later provider, is entering the subscription arena with the U.S. launch of Klarna Plus. For $7.99 a month, Klarna Plus enables eligible consumers to earn double rewards points on their purchases, pay no service fee when using Klarna at merchants outside of the Klarna …

Read More »