Clients using Recurly Inc. to manage their subscription-pricing models have a new feature to use. Recurly on Tuesday launched a ramp-pricing model that enables its clients to dynamically increase or decrease pricing within their subscriptions. This is in addition to the fixed, one-time, usage-based, tiered, volume, stairstep, and hybrid models …

Read More »Green Dot’s Henry Gone as the Prepaid Card Provider Appoints CFO as New CEO and President

Dan R. Henry, who took over as chief executive and president, from Green Dot Corp. founder Steven Streit in March 2020, is out. Green Dot announced Monday Henry, who previously held executive positions at Euronet Worldwide and Netspend, was “terminated” Oct. 14. That’s when Austin, Texas-based Green Dot named George …

Read More »Samsung Eyes 13 New Markets for Samsung Wallet

Consumer electronics giant Samsung Electronics is looking to expand to 13 new markets for its Samsung Wallet service. Announced Friday, the expansion of the digital-wallet platform will more than double its presence from the eight nations where it is already available. Samsung Wallet is the new brand for the combined …

Read More »Eye on Chargebacks: ACI Data Show Flat Fraud Attempts And Forter Debuts Smart Claims

Chargebacks are the bane of e-commerce retailers, but new data from ACI Worldwide Inc. indicate many may have them mostly in check. Separately, Forter launched Smart Claims, a product to help better manage chargebacks. Released Thursday, the new ACI data find that overall fraud attempts remained flat at 0.01%, despite …

Read More »Adobe Forecasts a Modest 2.5% Increase in Online Holiday Shopping Volume

With Halloween two weeks away, it’s time to start looking at the 2022 holiday shopping season and its potential impact on retailers and their payments volumes. E-commerce powerhouse Adobe Inc. is forecasting $209.7 billion in U.S. online holiday shopping purchases, up 2.5% from $204.5 billion in the Nov. 1 through …

Read More »As Consumers Return to In-Store Shopping, Fraudsters Follow

It’s a fact of the payments world that fraudsters are adept at watching and following consumer behavior to maintain their criminal revenue flow. Just as consumers have returned to shopping in stores, criminals have returned to the point-of-sale, albeit without neglecting their online activities. That’s the summation from Visa Inc., …

Read More »Eye on Mastercard: Efforts To Reduce E-Commerce Fraud And Ease Review of Crypto Purchases

The unceasing effort to eliminate e-commerce fraud while allowing legitimate transactions to flow unimpeded could be getting another boost as Mastercard Inc. pairs with Ravelin Technology Ltd., a machine-learning fraud platform, to better validate a consumer’s identity without adding friction to the checkout flow. Mastercard also introduced Crypto Secure, a …

Read More »Eye on Restaurant POS: Ziosk’s New Tablet; State of Restaurant Tech from SpotOn

Restaurants that use Ziosk products for their point-of-sale and ordering systems have got a new option for their servers to carry all day with the launch of the Ziosk PRO Server Tablet. In related news, a report from SpotOn Transact LLC reveals that 81% of independent operators continue to use …

Read More »46% of All Ransomware Attacks Happen in the United States, NordLocker Says

One country—the United States—accounts for 46% of all ransomware attacks, a sobering statistic revealed in a new report from NordLocker, a European cybersecurity provider. Yet, within the 50 states, not all have the same propensity for the nefarious attacks, NordLocker says, which analyzed multiple databases of ransomware incidents that affected …

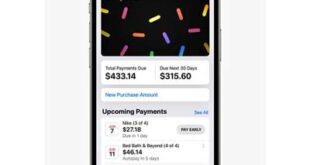

Read More »One More Thing? Apple Pay Later’s Debut Is Still Pending

Apple Inc.’s latest financial product, a buy now, pay later service called Apple Pay Later, has yet to arrive, though the iPhone operating system it was expected to require launched Sept. 12. Why is that? One Bloomberg columnist suggests Apple Pay Later, which was announced in June, may not arrive …

Read More »