Payment-card maker CPI Card Group said Thursday that new sales from an existing customer boosted its U.S. prepaid debit card revenue 26% in the second quarter. Littleton, Colo.-based CPI also reported that sold its United Kingdom business to private-investment firm SEA Equity for $4.5 million. With revenue of $15.4 million …

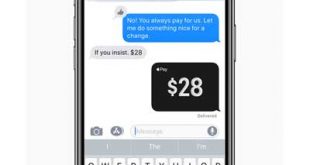

Read More »Apple Pay on Top of Consumer Reports’ Mobile P2P Assessment

With a focus on data privacy and security, a review of five mobile person-to-person payment services places Apple Pay at the top, Consumer Reports says. Released Monday, the report from the product-review magazine evaluated Apple Inc.’s Apple Pay, PayPal Holdings Inc.’s Venmo, Square Inc.’s Cash app; Facebook Inc.’s Messenger, and Early …

Read More »Cash Favoritism Still Benefits Cardtronics, Especially in the Wake of Payment-Network Failures

Cardtronics plc may have been one of the few companies to benefit from Visa Inc.’s June 1 outage in Europe. It notched a record high volume in the United Kingdom, Edward H. West, Cardtronics chief executive and director, told analysts during a conference call Thursday to discuss the ATM deployer’s …

Read More »Apple Pay Tops 1 Billion Quarterly Transactions As CVS and 7-Eleven Prepare To Accept It

Apple Inc. said Apple Pay transactions surpassed 1 billion in the company’s third quarter, ended June 30. During an earnings call with analysts Tuesday, Apple chief executive Tim Cook said the 1-billion mark was triple the amount a year ago. “To put that tremendous growth into perspective, this past quarter, …

Read More »Retailers’ Cost of Fraud Keeps on Rising. Now, It’s $2.94 for Every Fraud Dollar, LexisNexis Says

It’s a fact of doing business that retailers have to contend with fraud. Now, the cost of managing fraud has increased, says LexisNexis Risk Solutions in its 2018 True Cost of Fraud report for retailers. For every dollar of fraud, merchants pay $2.94, a figure that is 6% more than …

Read More »Buoyed by Its ISV Strategy, First Data Eyes a Joint-Venture Resurgence

Processor First Data Corp.’s strategy of providing payments integration to independent software vendors appears to be yielding results. The Atlanta-based company said it signed 94 ISVs in the second quarter. That, along with good growth in its direct-sales channel, contributed to the 17.1% growth in second-quarter revenue in First Data’s …

Read More »In a Bid To Spur Order-Ahead Restaurant Sales, Grubhub Pays $390 Million for LevelUp

Restaurant-services specialist LevelUp is being sold to Grubhub Inc. for $390 million. Announced Wednesday, the deal weds Boston-based LevelUp, with its expertise in digital ordering, payment, and loyalty, with Grubhub’s online and mobile food-ordering services. Chicago-based Grubhub also owns the Seamless, Eat24, AllMenus, and MenuPages brands. The deal is an …

Read More »An Integrated Payments Strategy Is Paying Off for TSYS

An integrated payments strategy appears to be paying off for processor Total System Services Inc. (TSYS). The Columbus, Ga.-based company says it signed 45 new integrated payments partners in the second quarter. “Coupled with a strong pipeline of software providers across a diverse set of verticals, we believe this high-growth …

Read More »eBay Adds Apple Pay Acceptance And Square Capital As It Unwinds Its PayPal Connection

Marketplace giant eBay Inc. will add Apple Pay acceptance for consumers and access to merchant funding via Square Inc.’s Square Capital this fall as the San Jose, Calif.-based company works on managing its own payments system. EBay is disengaging from payment services provided by PayPal Holdings Inc. In January, PayPal …

Read More »Blockchain Startup MakeCents Tests a Payments Platform It Says Bypasses Networks

With hopes of providing merchants with a lower-cost network to make and accept electronic payments, startup MakeCents announced Friday a test of its blockchain-based platform. New York City-based MakeCents says its decentralized platform is designed to “disrupt the $420 trillion global payments infrastructure by leveraging its blockchain technology to connect …

Read More »