While the Consumer Financial Protection Bureau is working toward an April 1, 2018, effective date for its massive rule for prepaid accounts, prepaid card industry advocates are urging the agency to further delay the rule by another year. In a comment filed this week with the CFPB, which regulates all …

Read More »Outback Franchisee Adding More Ziosk Tabletop POS Locations

Ziosk, a tabletop point-of-sale system owned by Tabletop Media LLC, said Wednesday that more than 100 Outback Steakhouse restaurant locations in the Southwest will use its devices. Cerca Trova Restaurant Concepts, the franchisee for Outback restaurants in Arizona, California, Colorado, Nevada, and New Mexico, is expanding the number of locations …

Read More »Last Year Saw Double-Digit Drops in Fraud Rates for Debit Issuers, Pulse Study Says

There’s some good news for U.S. debit card issuers in the form of reduced fraud rates, according to the 2017 Debit Issuer Study released Monday by Pulse, the electronic funds transfer network owned by Discover Financial Services. The fraud-loss rate for signature-debit transactions fell 30% from 2015’s 2.6 cents per …

Read More »New Data Helps ISOs Court SMB E-Commerce Merchants in the Top U.S. Cities

Acquirers wanting to tap into the ever-growing number of e-commerce merchants, especially small businesses, might do well to target a handful of U.S. cities with large bases of retail entrepreneurs. E-commerce platform provider Volusion released this week a list of the top 10 cities based on volume of merchants and …

Read More »There Are As Many as 500,000 U.S. ATMs Now, Says ATMIA

The estimated number of U.S. ATMs—including those deployed by financial institutions and independent operators, and branded machines—increased 10.5% to at least 475,000 and as many as 500,000, the ATM Industry Association said this week. The previous estimate, released in 2015, was 430,000, says David Tente, ATMIA’s executive director for the …

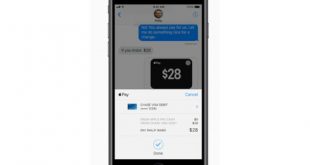

Read More »Green Dot Provides Some Details About its Role in the Upcoming Apple P2P Service

Prepaid specialist Green Dot Corp. released more details about its role in Apple Inc.’s upcoming person-to-person service in its Messages app. Apple announced the new feature in June and is expected to make it available this fall with an update to its iOS software for iPhone and iPads. Pasadena, Calif.-based …

Read More »With High and Low Spots, Open-Loop Prepaid Loads To Top $353.6 Billion by 2020: Report

Overall, the forecast is strong for open-loop prepaid cards—loads are expected to reach $353.6 billion by 2020—but not every segment will partake in the growth. That’s the assessment in a new report from Mercator Advisory Group Inc. Open-loop cards, which can be used at most merchants and carry a major …

Read More »Eye on Acquiring: Vantiv Debuts an API; ExaDigm Launches a Hospitality Terminal

Merchant processor Vantiv Inc. on Monday launched triPOS Cloud, a cloud-based application programming interface intended for independent software vendors and merchants looking to integrate payments with point-of-sale systems. As an API, triPOS Cloud enables developers to integrate payments functions with a few pieces of code. The service incorporates encryption and tokenization, …

Read More »ATM Kingpin Cardtronics Is Undeterred by Rising Cashless Payments—So Far

Evidence is emerging that efforts to convince more consumers to use contactless payments instead of cash for low-value transactions may be having an impact, at least in countries other than the United States for now. That’s the take from Cardtronics plc, the giant ATM operator that owned nearly 45,000 U.S. …

Read More »As Cross-Border E-Commerce Continues To Grow, Expect Payments To March in Step

Enabling cross-border payments for e-commerce transactions will take on greater importance if forecasts hold true. That means payments companies wanting to serve these merchants will have to adopt services that accommodate international payments. While U.S. and Canadian consumers will spend an estimated $72.7 billion on cross-border e-commerce in 2017, that …

Read More »