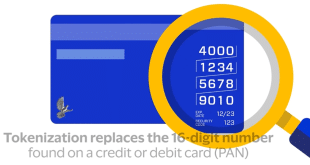

Visa Inc. says the 10 billion tokens it’s issued since 2014 are just the tipping point, as it expects Visa’s tokenized transactions to grow exponentially over the next several years. Visa announced the 10-billion milestone Tuesday. As of April, 29% of all transactions processed by Visa used tokens. Tokenization uses …

Read More »Eye on Real-Time Payments: BankSocial Debuts an RTP Service; Pidgin Enters a Correlation Collaboration

More credit unions will have access to real-time payments networks in separate deals announced Tuesday. BankSocial, a division of Fivancial Inc., launched its real-time payment service for credit unions. Meanwhile, Pidgin Inc. is working with core processing provider Corelation Inc. to enable broader real-time payments access to its clients. Dallas-based …

Read More »Human-Initiated Digital Attacks Rose 19% in 2023 While Account Takeover Remains Dominant

Account takeover, long the scourge of retailers and businesses, remained the top fraud type in 2023, according to the latest data from LexisNexis Risk Solutions. Released Wednesday, the “Confidence Amid Chaos” report found 28.7% percent of fraud in 2023 was third-party account takeover. That was followed by scams and bonus …

Read More »Visa Revamps its Payments Approach

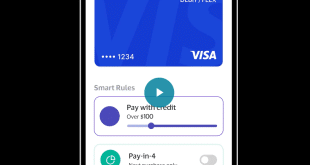

Visa Inc. is taking up the notion of a digital payment identity and making it part of its product mix. Announced Wednesday at the Visa Payments Forum in San Francisco, the Visa Flexible Credential is but one of several products the payments network formally debuted, including broader tap-to-pay capabilities, a …

Read More »Eye on ISVs: Booksy Adds Tap to Pay on iPhone; Usio Could See $20 Million in Revenue From a Single ISV

With an eye to making it easier for consumers to pay how they want, Booksy Inc., a booking platform for beauty-service appointments, is adding Tap to Pay on iPhone as an option. The contactless payment method enables consumers to use their contactless credit or debit cards, or an iPhone with …

Read More »Eye on Restaurants: Digital POS Hasn’t Changed Tipping Much, Survey Says; Shift4 Acquires Revel

More Americans are being asked to tip, but it doesn’t seem to have much positive impact for some workers, especially those employed by restaurants. Only 29% of these workers say their tips have increased in the past year, according to the “Beyond Gratuity: Perspective of Restaurant Staff Tipping Practices” report …

Read More »Eyeing a Competitive Restaurant Market, Square Launches a Kiosk

Square, the acquiring arm of Block Inc., is the latest to launch a dedicated kiosk for quick-service restaurants. Announced Tuesday, Square Kiosk combines hardware and software to enable self-ordering and payment. Available later this summer for all Square for Restaurants merchants, Square Kiosk accepts multiple payment methods including contactless and …

Read More »PayNearMe Enables Cash Toll Payments on Cashless Tollways

Growth in cashless tollways has been a boon for moving traffic. Now, PayNearMe Inc., a fintech that enables paying for online transactions with cash among other payment methods, says it is working with Kapsch TrafficCom to enable a way for those without access to in-car wireless toll payments to pay …

Read More »Chase Adds a Pay-Per-Use Real-Time Payments Option for SMBs

Chase, the banking arm of giant JPMorgan Chase & Co., introduced a suite of digital products it says will help small businesses improve their cash flow and payment processing. Among the services are the ability to choose a payment speed, such as standard automated clearing house, same-day ACH, or real-time …

Read More »Eye on Acquiring: Mohegan Picks PayNearMe in Pennsylvania; Xplor Capital Debuts

Online-gambling consumers in Pennsylvania using Mohegan Digital iGaming services will be able to use PayNearMe Inc.’s deposit and payout services. Announced Tuesday, the collaboration sees Santa Clara, Calif.-based PayNearMe’s MoneyLine as the exclusive payments platform for Mohegan Digital in that state. Mohegan, the Uncasville, Conn.-based parent company of numerous casinos, …

Read More »