As technology firms, both within financial services and those entering it, take larger shares of banking revenue streams and become more like banks, financial institutions will beef up their tech investments as they attempt to counter this pressure, advises Aite Group LLC in a report on 2018 financial-services trends. In …

Read More »Johnson Named PCI Security Standards Council Executive Director

The PCI Security Standards Council named Lance J. Johnson to the executive director position. Johnson, who had been chief operating officer at Sequent Software Inc. for the past five years and spent 20 years at Visa Inc., replaces Stephen W. Orfei, the general manager who left earlier this year after …

Read More »As 2018 Nears, Payments Professionals Predict Advances in Tech for Blockchain, Mobile, ID

The blockchain, mobile commerce, fraud, data breaches, and authentication were all hot payments topics in 2017. Expect that to continue into 2018 if the prognostications from several payments executives hold true. Much of their outlook centers on identity and authentication, especially as data breaches, large and small, continue to wreak …

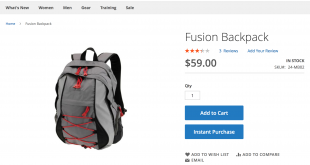

Read More »Magento Touts a One-Click Checkout Feature Following Expiration of Amazon’s One-Click Patent

E-commerce platform Magento Inc. announced Instant Purchase, its new one-click payment feature that is now standard on its Magento Commerce system. For merchants, Instant Purchase offers a customizable button, a mobile-optimized process that Campbell, Calif.-based Magento says can reduce time-to-purchase by 90%, automatic shipping to the shopper’s default address, and …

Read More »Quiet Online Shopping Days Yield the Biggest Fraud Spikes, Stripe Says

Santa Claus might be relaxing on Dec. 25, but criminals targeting online merchants with stolen credit and debit cards won’t be taking the day off. That’s evident from Stripe Inc.’s latest report on online fraud trends and behavior. Released this week, the report, which examines an undisclosed number of transactions made …

Read More »The Point-of-Sale Future May Be Handheld And Carry a Bevy of Benefits, Says Javelin

The seemingly unending growth in online shopping is doing more than closing physical stores. The point of sale in the stores that remain is changing, and along with it, payments providers, says Javelin Strategy & Research in its “2017-2021 Retail Point of Sale Payment Forecast.” As consumers continue to increase …

Read More »AmEx Says It Will End Its Signature Requirement, Leaving Visa As the Last U.S. Holdout

American Express Co. on Monday became the third of the four major U.S. card brands to announce it will cease requiring signatures for transactions made with its cards at the point of sale beginning in April 2018. AmEx says its rule change applies to all point-of-sale purchase transactions globally, a …

Read More »Discover Is the Latest To Erase a Signature Requirement for Credit and Debit Transactions

Discover Financial Services cardholders soon won’t have to sign for their credit and debit transactions made at the point of sale. As of April 2018, Discover is dropping the signature requirement for transactions made on the Discover Global Network in the United States, Canada, Mexico, and the Caribbean, the Riverwoods, …

Read More »Target Launches Wallet, Its RedCard-Based In-App Mobile-Payments Service

Target Brands Inc. finally unveiled its long-rumored mobile-payments service. Announced Monday, Wallet resides in the Target app for iOS and Android devices. Consumers can only enroll a Target RedCard, available as a debit or credit card, in the app. Target gift card enrollment is coming, too, the company says. To …

Read More »WePay Provides Volusion Payments Backbone As Chase Completes Its WePay Acquisition

Payments provider WePay is officially part of JPMorgan Chase & Co., WePay announced Monday. The banking giant wasted no time putting WePay to work as the backbone of a new payments service from Volusion LLC, an e-commerce platform. Chase announced in October it was buying Redwood City, Calif.-based WePay for …

Read More »