Nearly 18 months into the Covid-19 pandemic, consumer usage of contactless payments continues to grow, according to the most recent CardFlight Small Business Report. During the week ending July 18, contactless transactions increased 597.7% from the March 2020 baseline period. Contactless usage has been steadily increasing on a weekly basis …

Read More »Payveris Looks To Take On P2P Heavyweights With A Real-time P2P Payment Option

The hotly competitive peer-to-peer payments market got even more crowded Tuesday with the entry of Payveris LLC, a digital money-movement platform provider. The new service, which Cromwell, Conn.-based Payveris expects will compete with the P2P stalwarts Zelle, Venmo, and Cash App, will enable real-time P2P payments over the debit card …

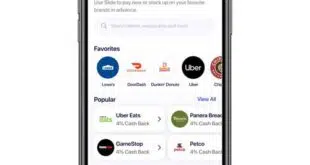

Read More »Slide Mobile Adds In-App Shopping for Online Purchases

Responding to consumer demand for an easier way to shop and earn rewards online, Raise Marketplace LLC announced Thursday the launch of an in-app shopping feature for its Slide mobile app. Consumers can now connect directly through the Slide app to the company’s more than 200 merchant partners to shop, …

Read More »Jumping on the Contactless Trend, Intuit Tries Again to Penetrate the POS Market

Sensing that consumers’ growing preference for contactless-payments options will be permanent, Intuit Inc. on Thursday introduced its QuickBooks Card Reader for small businesses. The terminal, which integrates with QuickBooks Payments, supports what Intuit calls smart-tipping functionality. Businesses can customize three tipping options that are displayed on the card reader as …

Read More »Trust And Security Could Be Big Hurdles As Apple Prepares Its Entry Into BNPL

For Apple Inc. to become a disruptor in the rapidly growing buy now, pay later market, the technology giant is going to have to win consumer’s trust and demonstrate its BNPL platform is secure. Reports of Apple developing a BNPL product, which the company has internally dubbed Apple Pay Later, …

Read More »Mobile Specialist Miura Introduces New Terminals And Apps for North America

United Kingdom-based mobile-payment specialist Miura Systems is expanding its operations in North America through the introduction of PCI PTS v5 certified terminals, a turnkey semi-integrated payment application, and a hosted device-management system. Miura, which has deployed more than 3 million payment devices to more than 30 countries, is also beefing …

Read More »KyckGlobal Adds Cross-Border Payments To Its Arsenal

KyckGlobal Inc. on Monday added cross-border payment capabilities to its platform by partnering with Moneycorp, a London-based provider of foreign exchange and global payment services to individual and corporate customers. The partnership will enable KyckGlobal to facilitate cross-border payments in more than 200 countries via wire transfers and international ACH transactions, …

Read More »And Then There Were Two: Colorado’s Passage of Surcharge Law Leaves Massachusetts and Connecticut As Only States With Surcharge Bans

With Colorado Governor Jared Polis signing Senate Bill 21-091, repealing the state’s ban on credit card surcharging, Colorado has a surcharging law that not only ensures proper disclosure about surcharges to consumers, but mirrors the surcharging rules implemented by Visa Inc. and Mastercard Inc. The new law, signed by Polis …

Read More »As Buy Now, Pay Later Usage Rises, It Bids to Become an ‘Option’ Rather Than Just a ‘Sweetener’

Consumer usage of buy now, pay later has increased significantly over the last couple of years. Research from Auriemma Consulting Group Inc. reveals the number of debit card holders offered a BNPL option in-store or online increased more than 10 percentage points between the first quarter of 2019 and the …

Read More »Eye On Payments for Professions: New Initiatives From DepositLink, LawPay, And Repay

With the Covid-19 pandemic accelerating the adoption of digital payments, it was only a matter of time before payments providers began pushing the technology beyond mainstream merchants, such as retailers and restaurants, and down to professions with specialized needs, such as realtors, attorneys, and healthcare providers. DepositLink Inc., a Boston-based …

Read More »