Embedded financial services specialist Jaris Inc. has launched a merchant onboarding service for independent sales organizations, processors, banks, and platforms. The Jaris utility enables merchants to apply for payment processing services and a suite of value-added services, such as business lending, instant payouts and banking services, through a single, pre-populated …

Read More »Southwest Airlines Adopts CellPoint’s Newest Platform; TreviPay Is the Latest Issuer on the UATP Network

CellPoint Digital announced early Tuesday Southwest Airlines Co. will begin using its cloud-native payment-orchestration platform. The platform, which launched last month, is designed for airlines and travel companies and supports multiple payment methods, including credit cards, travel credits, alternative payment methods, and Southwest Rapid Rewards frequent-flier points. Consumers can also …

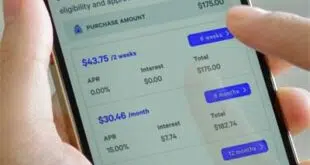

Read More »Walmart’s Decision to Oust Affirm in Favor of Klarna Unlikely to Significantly Harm Affirm’s Business

Buy now, pay later provider Klarna AB announced early Monday it is partnering with digital wallet provider OnePay to be the exclusive provider of installment loans to Walmart Inc.’s customers in the United States. Klarna is replacing rival Affirm Holdings Inc. as the retailer’s installment loan provider. Affirm had been …

Read More »Block Gets the FDIC’s OK To Take Consumer Cash App Borrow Loans In-house

Square and Cash App parent Block Inc. announced late Thursday its Square Financial Services Inc. industrial bank has received approval from the Federal Deposit Insurance Corp. to make consumer loans through Block’s Cash App Borrow feature. Square Financial Services launched as a Salt Lake City-based, FDIC-chartered industrial bank in 2021 …

Read More »The EPC Takes Aim at the CCCA And Illinois’s Interchange Law

The Electronic Payments Coalition has launched the latest salvo in its offensive against legislation seeking to regulate credit card interchange. This time the thrust takes aim at federal and state legislative efforts. At the federal level, EPC executive chairman Richard Hunt said during a press conference late Wednesday morning the …

Read More »How New Capital Positions Fortis to Pursue Faster Growth

Fortis Payment Systems LLC early Thursday announced it is receiving a capital infusion from a new investor, Audax Private Equity, as well as from an existing investor, Lovell Minnick Partners. The amount of the investment was not disclosed. A privately held company, Fortis actively began seeking new investors about six …

Read More »Dwolla Launches Open Banking Via Its Plaid Integration

Account-to-account payments provider Dwolla Inc. has launched an integration to open-banking platform Plaid Inc. The integration is expected to enable Dwolla users to verify accounts and check account balances in real time through a single vendor and application programming interface. Dwolla announced its partnership with Plaid late last year. The …

Read More »Affirm Extends Its Reach With Apparel Retailers; Splitit Offers a Digital Wallet

Buy now, pay later specialist Affirm Holdings Inc. continues to expand into fashion merchants through a partnership with online fashion-marketplace StockX. Apparel merchants are a fast-growing merchant category for Affirm. The BNPL provider has added 55 apparel sellers in the past six months, including StockX. In addition, transactions in its apparel and …

Read More »AmEx Adds an Expense Management Platform Via Its Center Acquisition

American Express Co. has acquired software developer Center. Terms of the deal, announced late Thursday, were not disclosed. The acquisition is expected to close in the second quarter. The deal will provide AmEx’s corporate and small-business cardholders with an integrated expense-management platform that delivers real-time visibility into all employee spending, …

Read More »Riskified Launches Adaptive Checkout; Socure Unveils Its Identity Manipulation Risk Score

E-commerce fraud prevention specialist Riskified has launched Adaptive Checkout, an app created to drive higher conversion rates by reducing false positives. The app leverages artificial intelligence to analyze each transaction based on its risk profile and the shopper’s purchase history. For example, a merchant’s best customers can be sent straight …

Read More »