Executives at Discover Financial Services Inc. early Thursday cut short their first-quarter 2024 earnings call, saying in advance they would not take questions after the presentation. Instead, equity analysts listening to the presentation were told to direct questions to Discover’s investor-relations team. On the call, executives duly reported a significant …

Read More »Visa Launches Enhancements for its Acceptance Platform

Visa Inc. on Wednesday unveiled enhancements intended to further remove friction from the customers’ payment experience for merchants of all sizes. The enhancements, which are being launched on Visa’s Acceptance Platform, were developed in response to merchants’ needs for simpler implementation of payments technology, Visa says. The enhancements include Developer …

Read More »As Data Drives Sales, Shift4 Adds A Business Intelligence Module to Its SkyTab POS System

Shift4 Payments Inc. says it has added a new business-intelligence module to its SkyTab POS platform for restaurants. The new module, aimed at dining establishments of any size, provides more granular data-filtering options for restaurants’ point-of-sale system, such as detailed transaction-management and revenue-center reporting. Chains can use the module to …

Read More »Restaurant Price Strategies Come Under Fire As Advocates Push to Pass a Credit Card Bill

As restaurants turn to surcharging and dynamic pricing to offset rising operating costs, consumer backlash is raising concerns the practice could negatively affect customer loyalty and ultimately, restaurant profits. The backlash comes hard on the heels of the Electronic Payments Coalition’s attacks on restaurant surcharges and other price increases. The …

Read More »A Card Industry Group Cites Retailers’ Price Boosts And Surcharges in Its Latest Campaign to Stop the CCCA

A trade group representing card networks and issuers is taking aim at restaurant surcharges and price increases by large grocers as part of its efforts to defeat the Credit Card Competition Act. The Electronic Payments Coalition’s first salvo in its new campaign against the CCCA was fired last week. In …

Read More »Despite BNPL’s Popularity, Overspending and Missed Payments Remain Top Issues, Bankrate Finds

Consumer demand for buy now, pay later loans may be high, but consumers are still at risk of overspending when using BNPL to finance a purchase or missing a payment. A survey released Thursday by Bankrate LLC reveals that overspending and missing a payment are two of the most common …

Read More »Embedded Payments Platform PayIt Aims at Hunters and Anglers Looking to Buy State Licenses

PayIt, a government-services platform and embedded-payments provider, has expanded its relationship with the Ohio Division of Wildlife to provide a digital-licensing system for hunters and fishermen. The deal is expected to offer a better process for online purchases and provide the agency’s staff with insights and tools to improve user …

Read More »How Discover Looks to Reap Call-Center Efficiencies With Generative AI

The generative AI revolution received a significant boost from Discover Financial Services with the card network’s announcement early Tuesday it is deploying the artificial-intelligence technology within the Google Cloud platform in Discover’s call center. With the deployment, Discover’s nearly 10,000 customer-service agents will have access to intelligent document summarization through …

Read More »Consumers Don’t See Any Benefit from the Credit Card Bill, a Bankers’ Group Contends

Merchants and credit and debit card issuers have controlled the bulk of the narrative, pro and con, about the proposed Credit Card Competition Act since the legislation was reintroduced last year. But now a recent poll from Independent Community Bankers of America says that most consumers feel they would not …

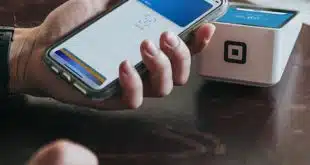

Read More »Mobile Wallets and Contactless Payments Growing in Popularity, NFC Forum Says

Consumers are not only favoring contactless payments more, they are relying more on their mobile wallets to initiate payments, according to the NFC Forum’s bi-annual Near Field Communication Usage and Adoption study. The study, conducted by ABI Research, reveals that 95% of respondents have left their physical wallets at home …

Read More »