Flexa Inc., a digital-payments provider, has introduced tap-to-pay for cryptocurrency transactions. The contactless-payment method enhances digital-asset usability by enabling blockchain payments via NFC-enabled hardware wallets without a mobile phone or internet connection, the company says. Hardware wallets, known also as burner wallets, are physical devices that store private keys for …

Read More »The Youngest Adults Favor BNPL Over Credit Cards, J.D. Power Finds

Generation Y and Generation Z are the biggest users of buy now, pay later, according to J.D. Power’s annual BNPL satisfaction study. Some 42% of both generations use BNPL products, compared to 21% of consumers from other generations, the study says. Both generations tend to favor BNPL over credit cards …

Read More »Observers And Lawmakers Handicap the CCCA’s Chances As It Heads Back to Congress

With expectations growing that the Credit Card Competition Act will soon be reintroduced in Congress, proponents of the bill feel its prospects for passage are better than ever. Helping fuel this optimism is growing bipartisan support for the bill, proponents say. “The Senate Judiciary Committee [hearing in November] showed there …

Read More »SoundHound AI Debuts a Next-Generation AI Ordering Platform for Restaurants

SoundHound AI Inc., a provider of artificial intelligence-based voice technology apps, strengthened its hand in the hotly competitive restaurant point-of-sale market early Tuesday with the introduction of an enhanced platform. The new platform will provide restaurants with the ability to connect all ordering channels to provide a “unified customer experience” …

Read More »How Zelle Has Become a Key Part of BofA’s Digital Interaction Strategy

Bank of America Corp. customers using Zelle initiated a record 1.6 billion transactions totaling $470 billion in 2024. Transaction volume increased 25%, and dollar volume 26%, last year compared to 2023. Zelle has become more popular than checks as a payment method, with Zelle transactions nearly triple the number of …

Read More »Block Looks to Cash App and Loans as Growth Drivers in 2025

Cash App was a big growth driver last year for Block Inc. and is expected to remain so as 2025 unfolds, the company said during a conference call late Thursday to discuss Block’s fourth-quarter results. Block is the parent company of the Square and Cash App businesses. During the last …

Read More »Galileo’s Debit Rewards Card; Mastercard’s Cards for Content Creators And Small Businesses

Galileo Financial Technologies LLC announced early Thursday the launch of a co-branded debit rewards card for the hospitality and travel industries. In addition to enabling debit card holders to earn rewards on their purchases, Galileo will use its card-issuing, processing, Cyberbank Digital, and program-management technologies to reduce time to market …

Read More »Mastercard Launches One Credential To Give Gen Zers Access to Multiple Payment Methods Via A Single Card

Mastercard Inc. announced early Wednesday the launch of One Credential, a digital-payment solution that supports multiple payment methods such as credit, debit, and prepaid, as well as installment loans, on a single card. Targeted primarily at Gen Zers, One Credential allows consumers to tailor their payment methods to better manage …

Read More »Toast Adds Perkins And Huddle House to Its Restaurant Menu

Toast Inc. has signed Ascent Hospitality Management, which owns and manages the Perkins American Food Co. and Huddle House restaurant chains, as a client. Ascent will install Toast’s payments platform in 500 Perkins and Huddle House locations initially. Ascent installed the first Toast platform at a Perkins location last fall, the …

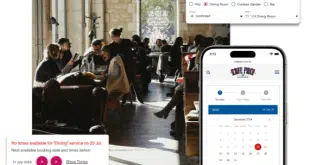

Read More »Now Book It Expands to Canada

Now Book It, a vendor of table-reservation and payments software for restaurants in Australia and New Zealand, has expanded to Canada. Canada has more than 100,000 locations that serve food, such as restaurants, cafés and brew pubs, generating $112 billion in annual sales, according to Restaurants Canada. In addition, 23 …

Read More »