Zelle, the peer-to-peer payment network operated by Early Warning Services LLC, reported Thursday that consumers and businesses sent 2.3 billion in payments totaling $629 billion through the network in 2022. On a year-over-year basis, transaction volumes through Zelle increased 26%, and total transaction value increased 28%. Small businesses continue to be …

Read More »Paymentus Partners With Citizens to Provide Real-Time Bill Payments

Citizens Financial Group is partnering with Paymentus Corp., a Charlotte, N.C., provider of bill-payment processing, to offer real-time electronic bill payment and money-transfer services for retail banking customers nationwide. Citizens will be rolling out Paymentus’s Bill Center and Loan Payments products. Bill Center provides users with a view of their bills …

Read More »Eye on Credit Cards: Bread Updates Financials; Choice Hotels’ Cobranded Card With Wells Fargo

Bread Financial Holdings Inc., a Columbus, Ohio-based provider of payments, lending, and savings services, on Tuesday released a performance update for January that showed strong gains in credit card and other loans held, but also showed a substantially higher delinquency rate. For the month of January, credit card and other …

Read More »Georgia Takes Aim At Interchange Levied on Sales Tax

Georgia has joined a small but growing number of states that have introduced legislation to ban the portion of credit and debit card transaction fees that apply to sales tax. The Georgia bill, introduced late last week by Georgia state senator Billy Hickman (R-Statesboro), proposes prohibiting the fees from being …

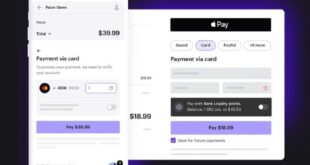

Read More »Mastercard Says It Will Work With Xsolla to Remove Friction From Videogame Purchases

Mastercard Inc. is teaming with videogame-commerce company Xsolla in an effort to smooth online-gaming checkouts by enabling new payment options for Xsolla’s videogame platform, the card network said. Mastercard cardholders will be able pay for gaming purchasing using credit card loyalty points from participating merchants and issuers. They can also …

Read More »Visa Rolls Out Incentives for Small Businesses To Use Its Business Card And Accept Digital Payments

Seeking to entice small businesses to pay for purchases using their Visa business card, Visa Inc. on Wednesday launched Visa SavingsEdge, a program that rewards small businesses that have Visa business cards with savings and discounts on business-related services from about 60 merchants. The rewards and incentives include everyday savings …

Read More »Fiserv “Is Better Than the Sum of Its Parts,” Its CEO Says As It Finishes ‘22 With Double-Digit Growth

Merchant acceptance, payments, and network and financial technology were the key pillars propelling Fiserv Inc.’s better -than-expected organic growth during the fourth quarter and for fiscal year 2022. Organic revenue growth—growth apart from recent acquisitions—for the three core segments of Fiserv’s business increased 17%, 9%, and 5%, respectively, compared to …

Read More »The U.S. Payments Forum Releases a Paper to Help Boost Sellers’ Adoption of PINless Debit

Seeking to improve merchant adoption of PINless debit transactions, the U.S. Payments Forum Monday released a white paper detailing the potential obstacles to PINless debit implementation in the United States and how they can be overcome. One advantage of PINless debit transactions is that they can be processed faster than PIN-based debit transactions, …

Read More »Air Travelers Pay For Checked Luggage Via Mobile Messaging App And Clickatell

Clickatell, a U.S. provider of mobile commerce and messaging solutions, announced late Thursday it is partnering with South Africa-based airline FlySafair to enable the airline’s customers to pay for checked luggage using the WhatsApp messaging channel. To make a payment, the airline’s customers access the WhatsApp channel on their mobile …

Read More »As Sellers’ Fees Rise, Satisfaction With Merchant Service Providers Declines, J.D. Power Finds

Merchant satisfaction with payment processors has dwindled in the past year, as sellers cope with the impact of inflation on their processing costs as well as on their business in general, according to J.D. Power’s 2023 U.S. Merchant Services Satisfaction Study. The merchant satisfaction score for merchant-services providers totaled 853, …

Read More »