Georgia has joined a small but growing number of states that have introduced legislation to ban the portion of credit and debit card transaction fees that apply to sales tax. The Georgia bill, introduced late last week by Georgia state senator Billy Hickman (R-Statesboro), proposes prohibiting the fees from being …

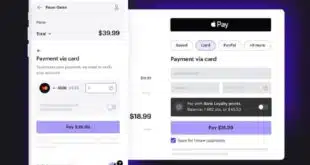

Read More »Mastercard Says It Will Work With Xsolla to Remove Friction From Videogame Purchases

Mastercard Inc. is teaming with videogame-commerce company Xsolla in an effort to smooth online-gaming checkouts by enabling new payment options for Xsolla’s videogame platform, the card network said. Mastercard cardholders will be able pay for gaming purchasing using credit card loyalty points from participating merchants and issuers. They can also …

Read More »Visa Rolls Out Incentives for Small Businesses To Use Its Business Card And Accept Digital Payments

Seeking to entice small businesses to pay for purchases using their Visa business card, Visa Inc. on Wednesday launched Visa SavingsEdge, a program that rewards small businesses that have Visa business cards with savings and discounts on business-related services from about 60 merchants. The rewards and incentives include everyday savings …

Read More »Fiserv “Is Better Than the Sum of Its Parts,” Its CEO Says As It Finishes ‘22 With Double-Digit Growth

Merchant acceptance, payments, and network and financial technology were the key pillars propelling Fiserv Inc.’s better -than-expected organic growth during the fourth quarter and for fiscal year 2022. Organic revenue growth—growth apart from recent acquisitions—for the three core segments of Fiserv’s business increased 17%, 9%, and 5%, respectively, compared to …

Read More »The U.S. Payments Forum Releases a Paper to Help Boost Sellers’ Adoption of PINless Debit

Seeking to improve merchant adoption of PINless debit transactions, the U.S. Payments Forum Monday released a white paper detailing the potential obstacles to PINless debit implementation in the United States and how they can be overcome. One advantage of PINless debit transactions is that they can be processed faster than PIN-based debit transactions, …

Read More »Air Travelers Pay For Checked Luggage Via Mobile Messaging App And Clickatell

Clickatell, a U.S. provider of mobile commerce and messaging solutions, announced late Thursday it is partnering with South Africa-based airline FlySafair to enable the airline’s customers to pay for checked luggage using the WhatsApp messaging channel. To make a payment, the airline’s customers access the WhatsApp channel on their mobile …

Read More »As Sellers’ Fees Rise, Satisfaction With Merchant Service Providers Declines, J.D. Power Finds

Merchant satisfaction with payment processors has dwindled in the past year, as sellers cope with the impact of inflation on their processing costs as well as on their business in general, according to J.D. Power’s 2023 U.S. Merchant Services Satisfaction Study. The merchant satisfaction score for merchant-services providers totaled 853, …

Read More »P97 Networks Taps Visa’s Token Technology For In-Car Payments

P97 Networks, a provider of cloud-based mobile-commerce technology to convenience stores, gas stations, and the automotive industry, is teaming with Visa Inc. to deploy Visa’s token technology as a way to reduce friction with in-car payments, as well as create new customer experiences for mobile-wallet users. P97 will use Visa’s …

Read More »Cash App’s Latest Feature Aims to Help Consumers Meet Their Savings Goals

Block Inc.’s Cash App unit says it is attempting to make it easier for consumers to salt away money with the introduction of Cash App Savings. The new feature allows Cash App users to deposit savings into a separate account within the app, build additional savings by rounding up their …

Read More »Despite Headwinds, E-Commerce Remained a Juggernaut Throughout the ‘22 Holiday Season

E-commerce transactions for the 2022 holiday-shopping season bested predictions for growth, despite signs of a weakening economy, according to research from ACI Worldwide Inc. From October through December, online transactions increased 21% from the same period in 2021, besting pre-holiday shopping- growth estimates by six percentage points, says ACI. In …

Read More »