With digital domestic money transfers expected to exceed 300 billion transactions globally in 2026, up from a projected 207 billion transactions in 2022, a nearly 50% increase, new players are expected to push the envelope by introducing alternative forms of digital cross-border transfers, such as cryptocurrency and central digital bank …

Read More »Synchrony Jumps Into The BNPL Game With an Assist From Fiserv’s Clover App Market

Synchrony Financial is the latest entrant in the highly popular, and increasingly crowded, buy now, pay later market. The Stamford, Conn.-based provider of consumer-financing products is partnering with Fiserv Inc. to allow merchants using Fiserv’s Clover platform to offer BNPL as a consumer-financing option. Called SetPay in 4, Synchrony’s BNPL …

Read More »Car IQ’s App Looks to Bring Fueling to Sunoco Fleet Customers at Nearly 5,000 Stations

Car IQ Inc. has inked a deal with petroleum company Sunoco LP to allow Sunoco’s fleet customers to purchase fuel without a credit card. Businesses, government agencies, and other organizations participating in Sunoco’s fleet program will be able to pay for gas at nearly 5,000 Sunoco stations by summer’s end …

Read More »Eye On BNPL: Blackhawk Network Teams With Klarna; Zip And Sezzle Pull Plug On Merger

Blackhawk Network Inc. is partnering with buy now, pay later provider Klarna AB to let consumers use Klarna’s interest-free payment solutions at physical retail locations. The deal, announced Wednesday, will enable consumers to make use of Klarna in-store for such items as groceries, electronics beauty, and more when shopping within …

Read More »Sionic Says Its CODE Pay Brings Real-Time Payments to the Point of Sale

Sionic Mobile Corp., a provider of consumer-to-business payments technology, on Tuesday launched CODE Pay a free mobile app for merchants that facilitates bank-to-bank, real-time payments at the point-of-sale. “Merchants have been looking for ways to cut costs and to get off the card network rails,” says Sionic chief executive and …

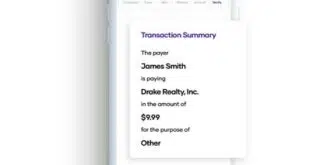

Read More »Eye on Real Estate: Bank Shot Adds Digital Checks; Prometheus Launches Crypto

Mobile-payment solution provider Bank Shot has added support for digital-check acceptance in the real-estate market. The new feature will enable consumers to initiate an earnest-money or rent payment via a digital check. In addition, real-estate brokers, title companies, and property managers can use Bank Shot to pay realtor commissions. Bank …

Read More »Eye On Acquiring: Deluxe Expands Processing; Nuvei Signs Delivery Platform WeCook

Deluxe Corp. announced on Thursday a deal with Dupaco Community Credit Union to process transactions for its business clients using its First American by Deluxe service. The Madison, Wis.-based credit union has more than 120 business clients. The service will also be made available to new Dupaco business customers, Deluxe …

Read More »Eye on Donations: Sionic Adds Real-Time A2A Payments; Givesmart Adds Apple Pay and Google Pay

Sionic Mobile Corp., a provider of omni-commerce, consumer-to-business payments technology, has introduced online and mobile widgets that enable non-profit organizations to accept real-time, bank-to-bank donations. Donors can use the apps, dubbed Pay-by-Bank, to initiate one-time or recurring donations direct from their bank account. Two key benefits of account-to-account donations is …

Read More »Usio Feels the Bite of the Crypto Meltdown, But Sees a Boost In ACH Volume

Despite increasing its automated clearing house volume in June, Usio Inc.’s overall processing volume is taking a temporary hit as one of its clients, digital-asset broker Voyager Digital LLC, announced it is suspending all buying and selling of cryptocurrency though its platform. San Antonio-based Usio made the announcement about the …

Read More »How GoCardless’s Deal for Nordigen Bolsters Its Position in Opening Banking

GoCardless Ltd., a specialist in the burgeoning field of account-to-account transfers, strengthened its hand Friday with the acquisition of Nordigen Solutions, a Latvian-based open-banking platform provider, for an undisclosed sum. The deal will allow GoCardless to connect to more than 2,300 banks in 31 countries to enable account-to-account payments, a …

Read More »