Mastercard Inc. joined the BNPL fray Tuesday with the introduction of Mastercard Installments. Consumers can access BNPL offers, either pre-approved through their lender’s mobile banking app or through instant approval at checkout, that can be used online or in-store wherever Mastercard is accepted. Consumers can choose from a variety of …

Read More »MX Technologies Partners With Pinwheel to Enhance Its Open Banking Platform

MX Technologies Inc. continues to grow its ecosystem of open-banking partners, announcing Monday it is partnering with Pinwheel, provider of an application programming interface for payroll applications. The deal will provide financial-technology service providers with expanded coverage of income verification and improved underwriting models for better lending decisions, which in …

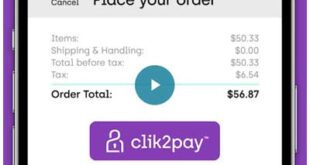

Read More »Startup Clik2pay Enables Consumers to Tap Their Bank Account For Online Purchases

Seeking to provide online merchants with a lower-cost payment option and consumers a better user experience, a 3-year-old, Toronto-based payment-service startup called Clik2pay is enabling Canadian consumers to pay for online purchases directly from their bank accounts at participating merchants. The new payment option, which launched Thursday, leverages the Interac …

Read More »A New Report Shows How the Growth in E-Commerce Is Fueling a Big Rise in CNP Fraud

Despite the percentage of card-not-present fraud transactions steadily hovering in the 10% to 13% range between the first quarter of 2020 and the same period in 2021, the average ticket size for fraudulent CNP transactions has steadily grown during that time, says a report from fraud-prevention platform provider Vesta Corp. …

Read More »Stripe Adds a Revenue Recognition Tool for Merchants That Book Sales Over Time

Online payments powerhouse Stripe Inc. Tuesday introduced Stripe Revenue Recognition, an application intended to automate the mapping of money to a balance sheet. The development of Revenue Recognition was spurred by the accounting needs of merchants and businesses that are paid upfront for goods and services to be delivered in …

Read More »Despite Booming E-Commerce Sales, Grocers Struggle With Online Profitability

Since the pandemic hit, e-commerce has been a boon for many merchants. Still there’s one merchant segment that has not fared so well with online sales: grocers. They’re finding the channel not particularly profitable, according to reports. Despite the number of online grocery shoppers increasing five-fold in 2020 compared to …

Read More »Check Partners With Procare To Provide Digital Payroll Services To Child Care Centers

Responding to child-care administrators’ need for improved payroll services, payroll-as-a-service startup Check Technologies Inc. has partnered with Procare Software LLC to provide digital-payroll services to Procare’s child-care center business-management platform. The deal comes at a time when strained resources during the ongoing Covid-19 pandemic have accelerated child-care centers’ need for …

Read More »Dwolla Partners With Metromile to Enable Digital Insurance Claims Payments

Seeking to improve the customer experience for insurance-claim payments, Metromile Enterprise Solutions LLC, an automated insurance-claims payments platform, is partnering with payment processor Dwolla Inc. to enable digital payments. With the Dwolla integration, insurance companies using Metromile’s Streamline platform can send claims payments in real time using The Clearing House …

Read More »BNY Mellon Teams Up With Verizon And Citibank to Offer Real-Time Bill Payment

Real-time bill payment took another large step forward Wednesday with BNY Mellon’s announcement it is partnering with Verizon Communications Inc. and Citibank to enable Verizon customers with Citibank accounts to pay their bills with near-instant effect. The agreement connects BNY Mellon as the billing bank, Verizon as the biller, and …

Read More »Behind SKUx’s Bid To Turn Coupons Into Digital Currency

In a bid to help brands and retailers counter fraud, counterfeiting, and misredemption losses from coupons, all of which can total more than $100 million annually, fintech SKUx early Tuesday introduced SKUPay. The application allows brands to replace paper and digital coupons with serialized digital offers that have individualized tracking …

Read More »