While the Covid-19 pandemic has deepened consumers’ reliance on contactless payments, as well as digital and mobile banking, a generation gap exists when it comes adoption of those technologies, separate reports from Oxygen, a San Francisco-based financial-platform provider, and digital consulting firm Mobiquity, have found. Of the more than 1,000 …

Read More »Having Exhausted Covid Scams, Criminals Are Returning to E-Commerce Fraud And Malware Attacks

Now that criminals have milked the bulk of their opportunities related to pandemic relief efforts, they are turning their attention back to their old standby, payments-related fraud. Not surprisingly, their target of choice is e-commerce, which has rocketed due to restrictions on the number of consumers allowed in physical stores and …

Read More »Google’s Link to Passport Is Part of a Broader Plan to Extend Google Pay to Parking And Transit

Passport Labs Inc., a provider of transportation software, announced Wednesday it is expanding its integration with Alphabet Inc.’s Google to enable payment for parking within Google Maps in more than 400 cities, including Boston, Cincinnati, Portland, Me., Norfolk, Va., Cheyenne, Wy., Westminster, Colo., and Green Bay, Wis. The integration of …

Read More »Crypto on a Credit Card? BitPay Says Its Simplex Deal Makes it Easier And Cheaper

As part of its ongoing efforts to make purchasing cryptocurrency easier and attract new users, Atlanta-based blockchain-payment processor BitPay Inc. is teaming with Simplex Payment Services, a Vilnius, Lithuania-based financial institution, to enable European consumers to purchase cryptocurrency using a credit or debit card and incur no cardholder fees for 45 …

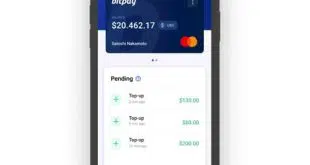

Read More »BitPay Moves to Boost Cryptocurrency’s Acceptance by Striking a Deal with Apple Pay

The push to increase the utility of cryptocurrency for purchases got a shot in the arm Friday as BitPay Inc., an Atlanta-based processor that offers crypto e-wallets, announced its prepaid Mastercard cardholders can add their card to the Apple Wallet and make purchases using Apple Pay. The BitPay Mastercard is …

Read More »Mogo Buys A Piece of Cryptocurrency Trading Platform Coinsquare

Payments-technology provider Mogo Inc. is initially acquiring about 20% of Coinsquare, a Canadian cryptocurrency-trading platform, for US$44.4 million, with an option to purchase another 20% in the future. Mogo’s first option to increase its investment in Coinsquare, which acts as the trading platform for MogoCrypto, which Mogo launched in 2018, …

Read More »How OLB Group Hopes to Win Over Merchants for Cryptocurrency Acceptance

Betting that consumer demand to use cryptocurrency as a payment vehicle will rise over the long term, payments provider The OLB Group Inc. announced Wednesday that its SecurePay payment gateway will support the acceptance of Bitcoin and other digital currencies at the point of sale regardless of the merchant platform. …

Read More »Gift Card Fraud And Credential Stuffing Led the Charge in Fourth-Quarter Fraud Attacks

Gift card fraud and credential stuffing, a technique in which criminals use stolen account credentials to gain access to legitimate user accounts, ran rampant during the fourth quarter of 2020, according to research by Arkose Labs, a San Francisco-based provider of fraud-prevention technology. Criminals launched 3.6 million attacks on gift …

Read More »Merchant Gripes Concern Fees And Onboarding More Than Technology, J.D. Power Finds

Against the backdrop of an overall decline in small businesses’ satisfaction with payment processors, Square Inc. ranks highest with a score of 857 out of 1,000, according to the J.D. Power 2021 U.S. Merchant Services Satisfaction Study. PayPal Holdings Inc. comes in second with a score of 852, with Bank of America Merchant …

Read More »Fiserv Enables Cash Withdrawals at ATMs Through Its CardValet Mobile Banking App

Fiserv Inc. on Wednesday announced CardFree Cash, a new feature within its CardValet mobile-banking app that allows consumers to facilitate a cash withdrawal from an ATM using their mobile phone. The service is available to financial institutions nationwide. Consumers can use CardValet at 30,000 Diebold Nixdorf and NCR ATMs driven by …

Read More »