With less than a year to go before gas stations are scheduled to become EMV-compliant at the pump, readiness among fuel merchants remains uneven. A recent study by Naples, Fla.-based ACI Worldwide reveals 47% of major petroleum merchants remain unprepared to meet the deadline and 20% are still in the …

Read More »Amid Covid-19, Fintechs Use Debit to Boost Their Lending, Savings, And Investing Apps

With underbanked consumers and gig workers looking for financial products to help them track spending, create savings, and manage debt, many financial-technology companies are layering debit products onto their core application to attract and retain customers. A driving force behind fintechs’ growing fondness for debit is that it is a …

Read More »Payments Will Help Lead a Post-Pandemic Rebound, a New Report Argues

Payments are expected to play a significant role in the economic recovery that will take place as the Covid-19 pandemic eases, says a new report from Boston-based Aite Group. The ways payments can help jump-start the economic recovery include reducing friction at the point-of-sale, increasing payment access, and integrating the …

Read More »The Pandemic Has Stoked Merchant Risk Along With Contactless Payments

With the Covid-19 pandemic accelerating consumers’ use of contactless cards and mobile wallets, merchants can expect hackers to target contactless transaction data at the point-of-sale, says Ruston Miles, founder and advisor at Atlanta-based Bluefin Payment Systems LLC. The main point of vulnerability in a contactless environment at the physical point-of-sale …

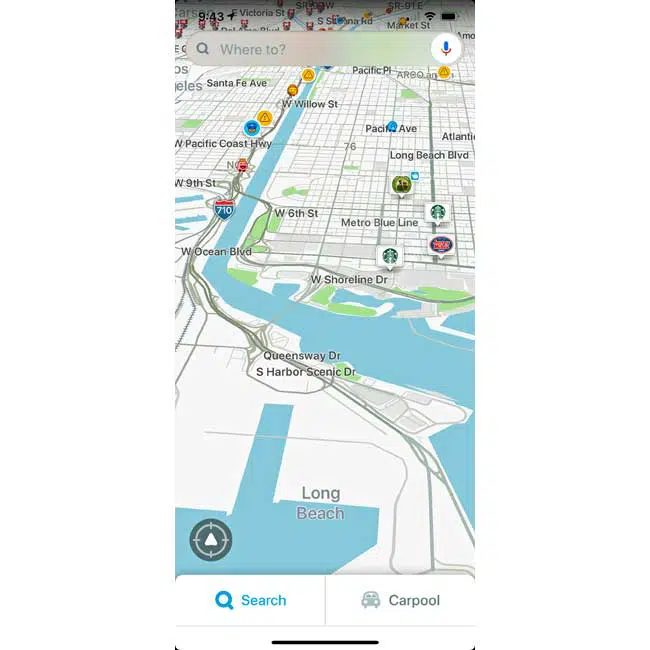

Read More »How Map App Waze Is Forging a Link Between Mobile Payments And Loyalty at the Pump

Now that Google’s Waze app has embedded a payment option into its software, the integration of navigation apps and payments and loyalty at the pump is under way, experts tell Digital Transactions News. Last week, Waze announced it has integrated an option that consumers can use to pay at the …

Read More »Standard Cognition Argues It Has a Better Alternative to Amazon Go. Will Circle K Prove It?

Standard Cognition Corp., a San Francisco-based provider of autonomous checkout systems based on artificial intelligence, expects to have the first of Alimentation Couche-Tard’s Circle K convenience stores retrofitted and up and running in early 2021, with potentially dozens more to follow. The first store to adopt the technology will be in …

Read More »E-Commerce Sales See Gains in July, But So Does Fraud, Says ACI Worldwide

The Covid-19 pandemic in July fueled a sharp rise in e-commerce but also in fraud, according to the latest figures from ACI Worldwide Inc. Global e-commerce transactions rose 19% in July over the same period a year earlier. Fraudulent transactions by value rose 4.4%, up from a 3.7% increase in …

Read More »Eye On Dining POS: Shift4 Adds Uber Eats; SpotOn Transact Buys SeatNinja

With the Covid-19 pandemic accelerating restaurants’ transition to digital payment technology, processors Shift4 Payments Inc. and SpotOn Transact Inc. have beefed up their platforms through deals to add third-party applications. Allentown, Pa.-based Shift4 has agreed to integrate San Francisco-based Uber Technologies Inc.’s Uber Eats delivery app to its point-of-sale platform. …

Read More »With a Compliance Deadline Looming, Technology Emerges to Ease Gas Pump EMV

Sound Payments Inc., a multichannel technology provider that offers point-of-sale solutions for the petroleum industry, expects its partnership with National Retail Solutions, a subsidiary of IDT Corp., to accelerate adoption of EMV at in-pump card readers among independent gas stations and convenience stores. Sounds Payments argues its EMV in-pump card …

Read More »Restaurant POS System Provider TouchBistro Acquires Loyalty Tech Developer TableUp

TouchBistro Inc., a software developer for iPad POS systems in restaurants, on Wednesday announced the acquisition of loyalty marketing application provider TableUp. Terms of the deal were not disclosed. The acquisition was driven by restaurant requests for ways to market and offer customer incentives to return as restaurants begin reopening …

Read More »