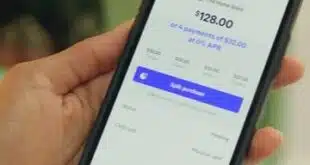

Seeking to beef up its buy now, pay later offering, Bread Financial on Monday launched the Bread Pay One-Time Use Card, a virtual credit card that allows consumers to pay for purchases in four installments.

The card, which will be issued by Marqeta Inc., can be used by consumers for online and in-store purchases. In-store shoppers at retailers accepting the Bread Pay card can apply for the card at the point-of-sale and use it immediately without downloading a third-party application or the need for integration into physical point-of-sale terminals. Consumers can also utilize their mobile phone and contactless technology to seamlessly access and utilize credit for purchasing, Bread says.

The ease with which consumers can apply for the card is expected to enhance the customer-shopping experience, Bread says. In addition to tapping Marqeta’s virtual card issuance capabilities, Bread will make use of Marqeta’s funding and tokenization capabilities.

“Bread Financial is at the forefront of innovation in the BNPL space, and this relationship is a continuation of our dedication to create tech-forward and industry changing solutions that give shoppers more flexibility and choice,” Val Greer, executive vice president and chief commercial officer for Bread Financial, says in a prepared statement. “We are proud to partner with Marqeta to offer new flexible payment options that will keep the merchant’s brand at the forefront of the path to purchase and deliver a more seamless experience for the end user.”

Offering a virtual card also gives consumers more ways to pay in the channel of their choice, the company adds. Bread launched its Pay in 4 capabilities in 2019.

Buy now, pay later has gathered immense momentum in recent years. A survey conducted by Marqeta in 2021 reveals that 47% of respondents surveyed had made use of a BNPL loan, up from 27% from in 2020.

Part of what makes BNPL loans so popular is that they increase consumers’ purchasing power, especially for large-ticket items they might other not make otherwise, allowing them to pay off the purchase in a predetermined number of monthly installments, either interest free or at a low interest rate. With inflation causing the price of goods and services to soar, that increased buying power can be quite attractive to consumers, payment experts say.

“Consumers demand flexible and convenient payment solutions, and growing demand for BNPL has led merchants across industries to look into new ways to offer that flexibility,” Simon Khalaf, chief product officer for Marqeta, says in a prepared statement. “We’re excited to work with Bread to streamline its BNPL offering and make it simpler for customers to implement BNPL across their checkout experiences.”