Six years after it shut down its last effort in mobile wallets for merchant payments, Square Inc. on Monday announced it is launching a new payments feature that will let users of its highly popular Cash App pay sellers in-store and online.

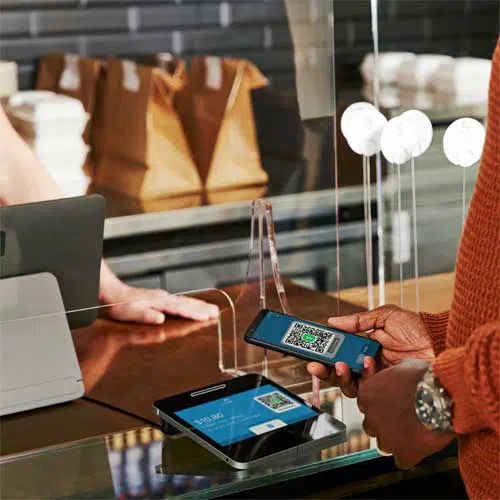

Cash App Pay, which can be used at participating sellers, lets users scan a Quick Response code or touch a button on their mobile device to make a payment from the wallet. Cash App, which was originally launched in 2013, includes features that allow users to pay each other and to invest in stocks. It also includes the ability to buy and redeem Bitcoin. Square said Tuesday the app has been adopted by 70 million active users.

Information was not immediately available regarding how many merchants are accepting Cash App Pay, which has been a “top-requested feature” for Cash App by both sellers and users, according to Square’s announcement. The new feature will “soon” be available to any Square merchant in the United States, the company said. The app is free to users, but information wasn’t immediately available about acceptance fees for merchants. Square’s standard rates are 2.6% + 10 cents for purchases made in-person and 2.9% + 30 cents for transactions through Square Online..

Square sellers can launch Cash App Pay acceptance with a software update, Square says, with no new hardware needed. Besides payments, other features include receipt management and reconciliation and settlement of Cash App Pay payments within the merchant’s existing Square system.

Some observers applaud Square’s latest product and see it growing fast in adoption and usage. “A large number of consumers are already using Cash App for P2P transactions so there isn’t any need to add an app to enable the process,” notes Thad Peterson, a senior analyst at Boston-based consultancy Aite-Novarica Group, in an email message. “And, with the number of merchants using some form of Square POS, [Square has] instantly created a robust two-sided platform with almost no incremental effort required by either consumers or merchants.”

Cash App Pay is the latest feature for an app that has proven to be a huge success for San Francisco-based Square. The company reported in August that gross profit for each monthly active transacting user totaled $55 in the second quarter, 2.5 times higher than two years earlier. To ease transactions, Square allows users to add funds in a variety of ways, including peer-to-peer transfers and stock or Bitcoin redemptions but also funds from debit cards and check deposits.

Square’s previous ventures in mobile wallets for merchant acceptance include Square Wallet, which it launched in 2011 and shut down three years later.

Weeks after discontinuing Square Wallet, Square introduced Square Order, which lasted less than a year. This app allowed users to place an order and pay for it on a mobile device, then show up later at the business—usually a coffee shop or café—to pick it up. Usage was hampered, however, by the fact that the service was available only in coffee shops in New York and San Francisco. Within a few months, Square was charging an 8% rate to merchants for Order transactions.

Observers like Peterson, however, see a brighter future for Square’s latest gambit. The inclusion of QR codes, in particular, could help propel Cash App Pay, according to Peterson. “The pandemic introduced QR codes to a large percentage of the U.S. consumer base, and now a wide variety of information can be transmitted or received through QR codes, from menu listings to payment information,” he notes. “It appears that Square is taking advantage of the rapid acceleration of QR code usage to create a very robust payment platform. It will add a lot of value for both their consumer and merchant bases.”