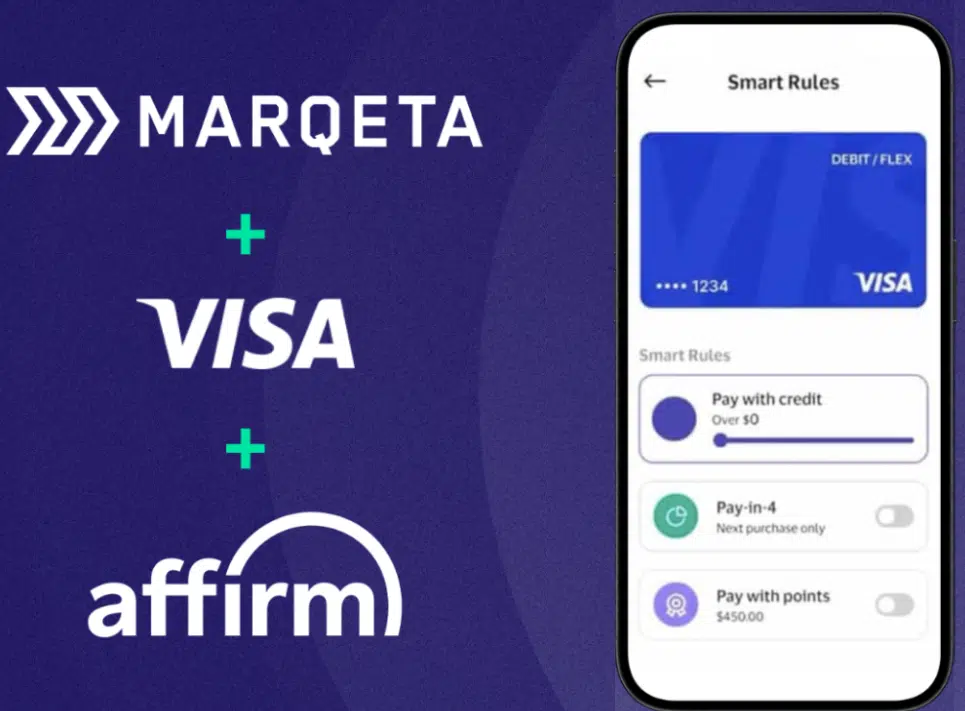

Marqeta Inc. early Thursday said it has become the first card-issuing platform to adopt technology announced earlier this year by Visa Inc. that lets cardholders toggle among a variety of payment methods for a single card rather than be restricted to the payment type indicated by the card itself.

Oakland, Calif.-based Marqeta said it has been working with both Visa and Affirm Inc., the buy now, pay later platform, to support the technology on its system. The flexible-credential technology lets cardholders choose from a list of payment methods when using a Visa card, including debit, credit, or BNPL, while relying on a single credential. Users could also choose to pay via rewards points, Visa says. The technology went live in Asia before coming to the U.S. market.

In the case of Marqeta, the flexible credential will let consumers using cards from the company’s clients choose a payment method. The technology is expected to launch later this year, with San Francisco-based Affirm supporting a BNPL capability. Marqeta has been certified by Visa to offer the multiplex credential, the card network says.

Analysts say the Visa initiative with Marqeta and Affirm may well succeed where similar efforts have fallen short. “There have been many attempts that allow cardholders to combine multiple payment cards into a single device, but many of those were cumbersome for the consumer to use and were limited to cards,” notes David Shipper, a strategic advisor at Datos Insights, via email. “So, while Visa is not the first to try this, [Visa Flexible Credential] simplifies everything for the end-user, making it more successful than other attempts. VFC will also create sales opportunities for the card issuer since the flexibility of having various payment options in one will be attractive to cardholders.”

Shipper adds that Marqeta’s move to adopt the technology will bring competitive advantages to the company. “Being the first issuer processor to market with VFC gives existing Marqeta card-issuing clients … a first-mover advantage in providing this functionality to the market. It will also make Marqeta more competitive for new debit and credit card-issuing clients until more issuer processors come online.”

Marqeta’s top officials appear to appreciate that advantage. “Combining the ubiquity and acceptance of Visa, with Affirm’s technology, underwriting and consumer experience with the simplicity and seamlessness of Marqeta’s platform is a win-win-win for consumers, merchants, and issuers,” notes Marqeta’s chief executive, Simon Khalaf, in a statement early Thursday.

Visa announced the flexible credential in May, along with other initiatives, including pay-by-bank capability supported by open-banking technology, and the potential for broader account-to-account payments.