Merchants using the CardFlight SwipeSimple app have gained easier access to managing customer data and a way to charge to card-on-file credentials. In related acquiring news, Bill Holdings Inc. launched its 1099 Filing service, which enables small businesses to simplify their 1099 taxes.

New York City-based CardFlight says the new functions are aided because customer data is synced across the cloud-based SwipeSimple platform, meaning merchants can access it via the merchant online dashboard or in the mobile app.

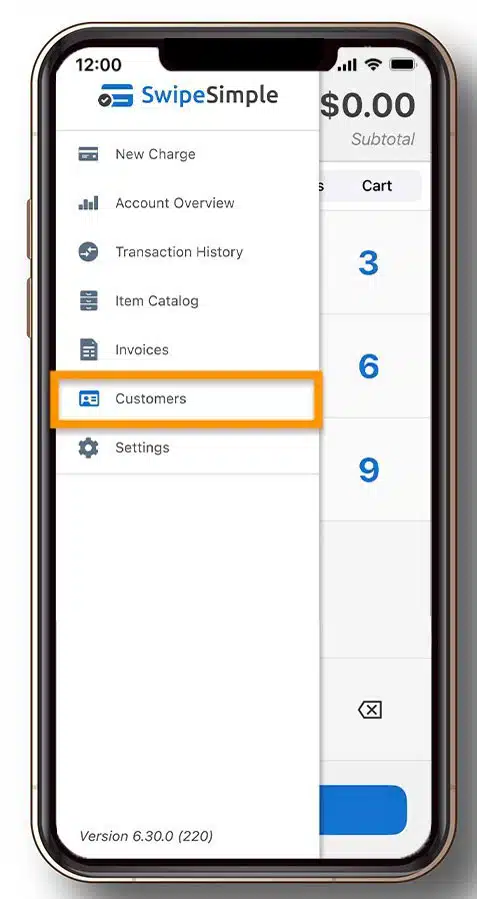

To use the new feature, merchants click the Customers tab in the mobile-app menu. From there, they can complete transactions using a card-on-file directly from a mobile device. CardFlight says this makes for a faster transaction and, for the customer, reduces wait time and eliminates the need to repeatedly enter payment details. CardFlight launched SwipeSimple in 2014.

In related news, Bill says its 1099 Filing service can help small businesses with their 1099 taxes when using the Bill Financial Operations Platform. Many acquirers hire sales agents as independent contractors and issue and track multiple 1099 tax forms. Additionally, 1099 forms are used for vendors providing other services.

The new service can help collect W-9 forms, which are used by contractors to provide their taxpayer identification numbers, and mark which of them are 1099 eligible, Bill says.

It also can generate 1099 documents, deliver these to contractors via the U.S. Postal System, and file the forms electronically with the Internal Revenue Service.