Second-quarter financial results from Houston-based Cardtronics Inc. show the country's largest non-bank ATM operator has more than doubled the number of ATMs it runs, to 26,241, in the year from June 30, 2004, primarily owing to its $106-million acquisition in June last year of E*Trade Financial Services' portfolio of 15,000 machines. Cardtronics has followed up that deal with a string of others, including most recently its acquisition of the 360-machine portfolio of Neo Concepts Inc., Chicago. In May, it expanded internationally with a deal to acquire Bank Machines Ltd. and its 1,000 ATMs in the U.K. Mostly as a result of this expansion, Cardtronics' second-quarter revenue ballooned 99% over the year-ago period, to $69.2 million. Second-quarter net totaled $200,000, down from $800,000. The company attributes the drop in net income to a rise in interest, depreciation, and other expenses tied to its acquisitions. The additional machines are also driving up transaction volume for Cardtronics, which saw volume jump 81% in the first half of this year over the same period last year, to 73 million transactions. Surcharge transactions as a proportion of the total came to 71%, down slightly from a year ago, while surcharge transactions per machine dropped dramatically, to 2,004 from 2,500. The company derived revenue of $2.35 per surcharge transaction in the first six months, compared to $2.15 in the first half of 2004, but its per-transaction expenses grew to $1.83 from $1.61, slicing its gross margin per transaction to 22.3% from 25.1%. Cardtronics has enjoyed some success recently with a strategy to get banks to brand its machines in retail stores. Its most recent such agreement came last month, when it announced JPMorgan Chase would brand 246 Cardtronics ATMs operating in Duane Reade pharmacies in New York and New Jersey, giving Chase customers surcharge-free access to the machines. Earlier, the bank had agreed to brand 215 ATMs Cardtronics had deployed in ExxonMobil stations in Texas.

Check Also

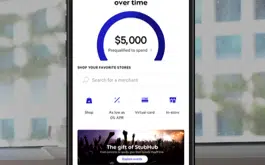

Affirm Expands Credit Reporting And Adds Adyen U.K. Clients

Installment-payments specialist Affirm Holdings Inc. will include all of its products in data sent to …