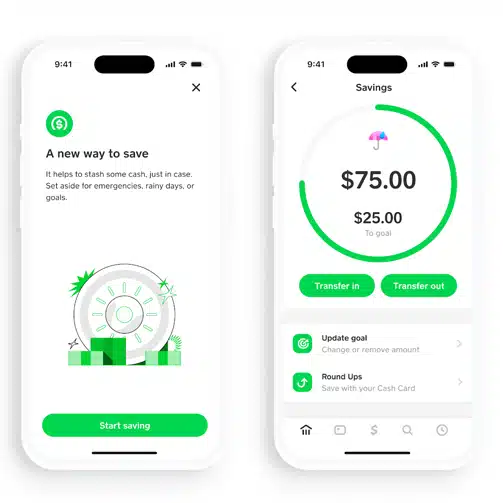

Block Inc.’s Cash App unit says it is attempting to make it easier for consumers to salt away money with the introduction of Cash App Savings. The new feature allows Cash App users to deposit savings into a separate account within the app, build additional savings by rounding up their purchases when using their Cash App cards, and set savings goals. The feature is being introduced at a time when the personal saving rate for Americans is the lowest it has been since 2005, according to the Bureau of Economic Analysis.

The roundup capability allows Cash App users to save money by rounding up purchases made using the Cash App card to the nearest dollar and having the spare change deposited into their savings balance.

As of September 2022, there were about 18 million active Cash App Card users, up more than 40% from the same time a year earlier, according to Block’s third-quarter 2022 financial statement. Users can also set a savings goal, such as for an upcoming trip, and designate their savings balance with an emoji, such as an airplane to represent savings for future travel. The app allows users to transfer funds to other users and also enables purchases and redemptions of Bitcoin.

No minimum balance is required to use the new savings feature, doing away with a barrier to consumers cite when trying to establish a savings account for the first time, Cash App says.

In 2021, Square Inc. began operating Salt Lake City, Utah-based Square Financial Services, a financial institution chartered by the Federal Deposit Insurance Corp. and Utah Department of Financial Institutions. The bank is capable of offering business loans and deposit products. At the time of the launch, Square said SFS would be the primary provider of financing for Square sellers across the United States. Cash App executives were not available to comment on whether the institution will hold the savings deposits of Cash App users. SFS is an independently governed subsidiary of Square.

“Many Cash App customers are already treating Cash App as an informal savings tool, and a separate savings balance was one of the most asked-for features,” Ryan Budd, head of financial services for Cash App, says in a prepared statement. “We’re constantly evolving our offerings to meet the needs of our customers and can’t wait to deliver even more functionality to help our customers save and grow their money.”

A savings offering is viewed by many fintechs as a value-added feature, along with lending and investment. A 2022 study by consumer financial-services company Bank Rate LLC revealed that less than half of Americans have enough savings to cover a $1,000 emergency.

In its 2022 third-quarter financial statement, Block said banking-product adoption is a primary focus for Cash App as its looks to move beyond peer-to-peer payments as a way to deepen customer relationships. “Our suite of banking products, such as Cash App Card and direct deposit, have had some of the fastest-growing attach rates across our ecosystem,” Block said at the time.