The history of payments in the last century has been a fascinating journey. From gold-backed paper currency to a fiat model that grew beside the convenient credit card system, the method in which we transact has always been reflective of society’s technological capabilities at that time. Even as late as …

Read More »Veem Adds Products for SMBs and other Digital Transasctions News briefs from 7/21/21

Payments provider Veem Inc. launched several new products for small businesses, including Veem Invoicing and Veem Collections.Cryptocurrency platform OKCoin USA Inc. has chosen FIS’s Worldpay unit to provide merchant acquiring and global exchange service in support of OKCoin’s ongoing global expansion.Visa Inc. said it will launch later this year an “evolved” brand identity featuring refreshed …

Read More »Mastercard Outlines a Pilot for Direct Acceptance of Cryptocurrency Via Stablecoins

Card-based cryptocurrency transactions at the point of sale require conversion of the crypto assets to fiat currency for acceptance by the card networks. Now, the two top card networks are starting to change that. Mastercard Inc. early Tuesday said it will work with a pair of issuing banks and several …

Read More »COMMENTARY: B2B Payments are Broken. Here’s What the Industry Can Learn from Consumers

The consumer-payments industry is thriving. Last year, consumers embraced more payment methods than ever, a behavior that companies like Stripe (now valued at $95 billion ahead of a highly anticipated Wall Street debut) are banking on in a post-Covid world. In fact, a recent Deloitte report tells us that, in …

Read More »Slide Mobile Adds In-App Shopping for Online Purchases

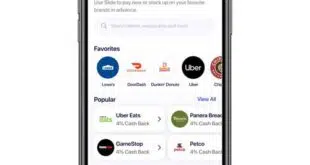

Responding to consumer demand for an easier way to shop and earn rewards online, Raise Marketplace LLC announced Thursday the launch of an in-app shopping feature for its Slide mobile app. Consumers can now connect directly through the Slide app to the company’s more than 200 merchant partners to shop, …

Read More »Discover Is the Latest Card Network to Bust Into BNPL, a Market With Heated Rivalry

The buy now, pay later trend has gained enough steam that the major card networks can’t afford to ignore it. The latest evidence that the credit card giants want to hedge their bets came this week with the news that Discover Financial Services invested $30 million in Minneapolis-based Sezzle Inc., …

Read More »Jumping on the Contactless Trend, Intuit Tries Again to Penetrate the POS Market

Sensing that consumers’ growing preference for contactless-payments options will be permanent, Intuit Inc. on Thursday introduced its QuickBooks Card Reader for small businesses. The terminal, which integrates with QuickBooks Payments, supports what Intuit calls smart-tipping functionality. Businesses can customize three tipping options that are displayed on the card reader as …

Read More »Microsoft Tops the 10 Most-Phished List, But Three Big Payment Brands Also Appear

Phishers trying to manipulate recipients of their ill-intended emails overwhelmingly target Microsoft Corp., according to the Brand Phishing Report for Q2 2021 from Check Point Software Technologies Ltd. Payment brands Chase, Apple Inc., and PayPal Holdings Inc. round out the report’s top 10 list for the quarter. The results indicate …

Read More »Trust And Security Could Be Big Hurdles As Apple Prepares Its Entry Into BNPL

For Apple Inc. to become a disruptor in the rapidly growing buy now, pay later market, the technology giant is going to have to win consumer’s trust and demonstrate its BNPL platform is secure. Reports of Apple developing a BNPL product, which the company has internally dubbed Apple Pay Later, …

Read More »Failed Payments Cost Banks, Fintechs, And Companies Nearly $120 Billion Last Year

As banks, merchants, and fintechs scramble to win share in the payments business, they can easily lose sight of the fact that not all payments process properly. In fact, many don’t. Some two-thirds of organizations sustain more than 20,000 failed payments each day, while the toll taken globally by all …

Read More »