Ria Money Transfer, a unit of Euronet Worldwide Inc., said its services will be available in more than 2,000 Kroger stores. Ria also announced that Fiesta Mart, a grocery chain based in Texas with 59 stores, will offer its money-transfer services.A survey from daVinci Payments found that 52% of women intend to spend …

Read More »More Affinity for Contactless, But Also More Fraud Fears, a Fiserv Consumer Survey Reveals

Unlike the case with previous changes in consumer payment behavior that took years, if not decades, the Covid-19 pandemic has accelerated adoption of touchless payments, as more and more consumers look for hygienically safer and convenient ways to pay, says a Fiserv Inc. report released Friday. The report surveyed 1,037 consumers …

Read More »USAT Completes EMV Advance and other Digital Transactions News briefs from 10/26/20

USA Technologies Inc., a payments-technology provider for the vending-machine business, announced it has completed the introduction of EMV and contactless EMV acceptance capability for its ePort G10-Chip reader line. The enhancement process was launched in February.The Western Union Co. said it now has added bank accounts, wallets, and cards to its …

Read More »‘We Hope the Worst Is Behind Us’ Says AmEx’s Boss As the Company Shows Signs of a Comeback

As the economy registers a tentative recovery from the deep recession caused by Covid-19, payments networks are doing likewise. This is probably no more true than with American Express Co., whose concentration in the travel-and-entertainment market caused the company’s financials to nosedive earlier this year as the pandemic grounded airlines, …

Read More »Alliance Data Shifts Its In-House Private-Label Processing Operations to Fiserv

Alliance Data Systems Corp., a provider of loyalty and marketing services, is moving its nearly 24-year-old in-house private-label card processing operations to Fiserv Inc. The move is part of Alliance Data’s strategy of investing in the development of new digital services for its customers, such as offering credit options to …

Read More »Discover Volume up 11% and other Digital Transactions News briefs from 10/22/20

Discover Financial Services reported its payment-services volume totaled $69.7 billion in the third quarter, up 11% year-over-year. Volume on the Pulse debit network increased 16% to $55 billion owing to larger average spending due to the pandemic and to the lift from stimulus funds.Payments provider PaymentCloud Inc. said it acquired contactless technology startup …

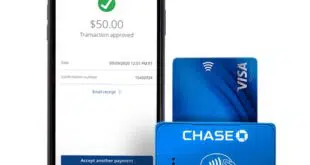

Read More »Eye on Acceptance: Visa Rolls Out Tap to Phone; Chase Launches QuickAccept

Visa Inc. on Wednesday announced the rollout in 15 geographic markets of Visa Tap to Phone, which allows consumers to initiate a transaction simply by tapping a contactless card to a merchant’s NFC-enabled mobile device. Tap to Phone is now live in numerous countries throughout Europe, Middle East, Africa, Asia …

Read More »PayPal Dips into Crypto and other Digital Transactions News briefs from 10/21/20

PayPal Holdings Inc. announced a service that allows account holders to buy, hold, and sell cryptocurrency directly from their account. The company also said it will make cryptocurrency available as a funding source for purchases at the 26 million merchants worldwide that accept PayPal.Payments provider FIS Inc. said it added pharmacy chain Walgreens …

Read More »Transaction Pricing Levels Out, According to a New Strawhecker Report

Last conducted in 2016, the latest Third-Party Processing Pricing Benchmark Study from The Strawhecker Group indicates that debit and credit card transaction pricing appears to have leveled off. The average value of an IP-connected front-end authorization and capture action in 2020 is $0.016 for jumbo wholesale acquirers, or those with …

Read More »Graylin’s and Wallner’s New Venture and other Digital Transactions News briefs from 10/20/20

Payments industry veterans Will Graylin and George Wallner launched a fundraising campaign on Indiegogo for OV Valet, their new company that wants to offer Superkey, a fob that uses near-field communication and magnetic secure transmission technology, to enable tap-and-pay payments.Payments-technology provider VoPay International Inc. said it is working with Visa Inc. to integrate the …

Read More »