Commerce platform FreedomPay said it will begin offering point-of-sale devices from Pax Technology Inc. in the second quarter next year. Visa Inc. announced it will deploy its real-time payments network, Visa Direct, to allow users of United Kingdom-based money-transmission platform Paysend to route payments to eligible Visa cards in 170 countries and territories. …

Read More »Intuit Makes a Bid for More Small-Business Payments With a New Combo Service

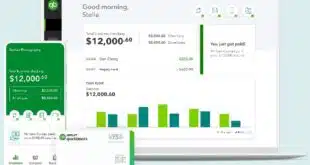

Intuit Inc., developer of the QuickBooks accounting software and related services for small businesses, embedded itself further into the payments business on Wednesday when it unveiled QuickBooks Money. The free product allows businesses to send invoices accepting payment choices including credit, debit, automated clearing house, PayPal, Venmo, and Apple Pay …

Read More »Eye on Processors: Wix Debuts Tap to Pay on Android; Adyen Issues 2 Billion Tokens

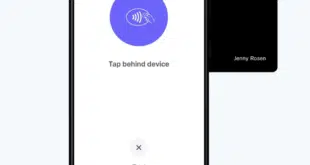

E-commerce platform Wix.com Ltd. looks to make it easier for its merchants with stores to accept physical payments with the debut of Tap to Pay on Android. The technology, coming from Stripe Inc., means merchants can accept contactless payments with a regular Android smart phone and no additional hardware. Tap …

Read More »PCI DSS 4.0 Compliance Concerns And Other Digital Transactions News briefs from 9/12/23

Some 90% of businesses are “concerned” about whether they will be able to meet a March 2025 deadline for compliance with PCI DSS 4.0, a newly updated payments-security standard, according to a survey from payments-security firm Bluefin and S&P Global Market Intelligence. The survey was conducted during the second quarter and included …

Read More »Commentary: BNPL May Be All the Rage, But Embedded Lending Is a Better Option for Merchants

According to Juniper Research, 360 million people worldwide used Buy Now, Pay Later (BNPL) in 2022. With such an expansive consumer base, BNPL has also become an effective tool for merchants to attract new customers and increase conversion rates. However, the widespread use of BNPL has raised concerns regarding transparency …

Read More »Moving Cards from Plastic to Paper And Other Digital Transactions News briefs from 9/6/23

Prepaid card platform Blackhawk Network said it is working with Visa Inc. to convert its Visa-branded cards from plastic to paper-based materials. Payments provider Central Payments released PayCP, its payout platform that initially includes a virtual Discover prepaid card, a physical Discover prepaid card, push to debit cards via Mastercard Send, and ACH bank …

Read More »Infinicept Offers Launchpay, a Path for Software Companies to Become a Payfac

Infinicept, a provider of embedded payments, Tuesday introduced Launchpay, a payment facilitator (Payfac)-as-a-service model for software companies not yet ready to become full-scale payment facilitators. Payment facilitators allow customers to accept electronic payments using their platform through a master merchant account. Examples of Payfacs include Block Inc.’s Square merchant-processing unit …

Read More »Mastercard Denies Rate Bump Assertion And Other Digital Transactions News briefs from 9/5/23

Mastercard Inc. denies an assertion it intends to raise interchange rates in October following an Aug. 30th story in The Wall Street Journal about interchange rate adjustments expected from Mastercard and Visa Inc. in October and April. Mastercard said the article relied on a report from an advisory firm that is advocating for legislation that …

Read More »Vet Platform Otto Secures $43 Million in Financing And Other Digital Transactions News briefs from 9/1/23

Otto, a business and payments platform for veterinary practices, announced a $43-millon Series B equity-financing round. The company, formerly called TeleVet, now claims more than 8,000 clinics. Nexo introduced its Nexo Card, a Mastercard-branded card that allows holders to use as either a credit or debit card on each transaction, with …

Read More »Debit Is Consumers’ Preferred POS Payment Method, Well Ahead of Credit Cards

Debit cards are the most widely used form of payment, while credit cards rank a distant third, a new study from J.D. Power says. Some 78% of consumers use debit cards at the point of sale, followed by cash (74%) and credit cards (66%), according to the survey. Other forms …

Read More »