In reconnecting with the payments industry after my Congressional run, one topic has come up in conversation more than any other: interchange regulations. Specifically, S.1838, the Credit Card Competition Act of 2023 (CCCA), which takes a market-driven approach to driving down interchange fees. By enabling two credit card networks on …

Read More »Mastercard Addresses the Fate of Cap One’s Debit Cards

The pending $35.3-billion merger of Capital One and Discover has concentrated minds in the payments industry for nearly a year, but perhaps nowhere so much as at Mastercard Inc. That became apparent early Thursday as equity analysts quizzed the card network’s top brass about the combination’s potential impact on Mastercard, …

Read More »Opponents of the Illinois Interchange Law Hedge Their Bets With Legislation To Repeal It

A bill was introduced late Tuesday in the Illinois House of Representatives seeking to repeal the Interchange Fee Prohibition Act. The legislation, introduced by Rep. Margaret Croke, chairperson of the House Financial Institutions and Licensing Committee, is the latest twist in an ongoing battle over the IFPA, which became law …

Read More »Porter Airlines’ New Card and other Digital Transactions News briefs from 1/29/25

Porter Airlines this spring will launch its VIPorter Mastercard card program, working with Mastercard Inc. and the Canadian banking giant BMO. Payments platform Repay announced an integration with the underwriting platform Worth to allow for faster merchant onboarding and vendor connections. Credit union service organization Velera released its card-on-file service that enables cardholders to update …

Read More »XMoney Signs Visa as Partner and other Digital Transactions News briefs from 1/28/25

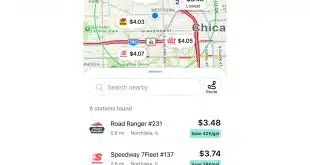

X, the social media platform formerly known as Twitter, appears to have signed a deal with Visa Inc. for the card brand to be a partner in XMoney Account, the platform’s possible payments service, reported CNBC.com. Fuel discount platform GasBuddy launched its Pay with GasBuddy+ card issued by Fifth Third Bank N.A. bearing the …

Read More »C-Store Chain RaceTrac Deploys 10-4 by WEX for Cardless Fuel Payments

RaceTrac Inc., an Atlanta-based convenience store chain with more than 800 locations, is debuting cardless payments for truck drivers via the 10-4 by WEX app. The free app enables independent owner-operators to pay for diesel fuel without a physical card at the pump. Users upload their credit or debit card …

Read More »AmEx Closes Out 2024 On a High Note As Growth Proves Steady

Top executives at American Express Co. early Friday celebrated the final quarter of what they said was a year to remember. “We delivered record revenue, record net income, and new records in many categories,” including all-time-high cardholder spending, AmEx chief executive Steve Squeri told equity analysts during a conference call …

Read More »Merchants Are Turning to Credit Card Surcharges As Processor Satisfaction Declines, J.D. Power Finds

Merchants are increasingly levying surcharges on purchases made with credit cards to help offset processing fees, a new study from J.D. Power finds. Some 34% of merchants surveyed are adding surcharges for credit card transactions, the study says. The study also found that flat-rate pricing lends merchants greater impetus to …

Read More »Discover Volume up 4% and other Digital Transactions News briefs from 1/23/25

Discover Financial Services reported payments volume of $102 billion for the fourth quarter of 2024, up 4% year-over-year, including a 7% rise for the Pulse electronic funds transfer network and a 9% increase for Diners Club. Overall, the company reported a 14% increase in revenue net of interest expense, to $4.76 …

Read More »Maryland Is the Latest Batter to Take a Swing at Regulating Interchange on Sales Tax and Tips

The Maryland legislature held a hearing late Tuesday on a bill prohibiting interchange from being charged on sales tax and gratuities linked to credit and debit card transactions. The bill, introduced by Delegates Todd Morgan and Brian Crosby, is the latest in what is expected to be a flurry of …

Read More »