On Saturday, a final rule issued in October by the Federal Reserve goes into effect, requiring that all issuers offer a choice of at least two networks for routing online debit card transactions. The update, derived from the 2010 Durbin Amendment, has been a bone of contention for years between merchants and issuers. …

Read More »Square Unveils Its AmEx Card for Merchants as Part of Its Banking Expansion

Fulfilling a promise it made seven months ago, Block Inc.’s Square merchant-acquiring unit on Wednesday announced it will offer an American Express-branded credit card to its sellers that gives rewards in the form of lower processing costs. Square also announced several enhancements to its financial services to get more of …

Read More »Tap to Pay Arrives for Venmo And PayPal Zettle

PayPal Holdings Inc. is adding tap to pay on mobile phones to its U.S. Venmo users with business profiles. The Tap to Pay on Android technology enables merchants that accept Venmo payments to do so using conventional Android smart phones without having to attach a special payment dongle. The service …

Read More »Processors Are Starting to Adopt AI, But Consumers May Not Be Entirely Onboard

The explosive potential that lies in recent advances in artificial intelligence is beginning to be felt in the payments business as banks and fintechs search for ways to wring intelligible trends and operational improvements out of enormous masses of data. The nascent trend toward AI in payments was underscored by …

Read More »Travel Chargebacks up 71% And Other Digital Transactions News briefs from 6/27/23

Travel companies experienced a 71% growth in chargebacks in the past few years, according to the “Tackling the Travel Chargeback Challenge” report from Outpayce from Amadeus, a global travel company. The survey canvassed 46 airline and travel agent executives in the second quarter. The Accredited Standards Committee X9 Inc. started an industry forum …

Read More »Eye on Acquiring: FreedomPay Lands IHG Properties and Helcim Adds a Surcharging Option

IHG Hotels & Resorts, with close to 4,000 properties, will use FreedomPay Inc.’s payment technology, the payments provider said. Meanwhile, Helcim launched its Helcim Fee Saver surcharge program. Philadelphia-based FreedomPay says its FreedomPay Commerce Platform will provide the payments functionality for multiple IHG brands, including InterContinental Hotels & Resorts, Kimpton, …

Read More »$362 Billion in Online Fraud Loss And Other Digital Transactions News briefs from 6/26/23

Merchant losses from online payment fraud globally will total more than $362 billion in the years from 2023 to 2028, according to a forecast from Juniper Research. So-called swipe fees on credit card transactions will increase Fourth of July costs for U.S. consumers by more than $500 million, according to the Merchants Payments …

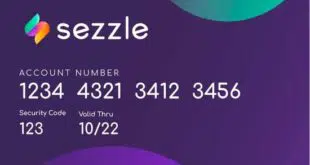

Read More »Sezzle Pay Anywhere Debuts To Broaden Sezzle’s BNPL Acceptance

As buy now, pay later use continues to grow—U.S. volume could reach $6.5 billion by 2027, one report says—provider Sezzle Inc. is taking a step it says will ensure consumers can use its installment payment service where they like to shop. It launched Sezzle Pay Anywhere, a subscription-based service that …

Read More »Secure Technology Alliance Marks 30 Years And Other Digital Transactions News briefs from 6/23/23

JPMorgan Chase has extended its JPM Coin, a blockchain-based settlement token launched in 2019, to euro-denominated payments. More than $300 billion has been processed on the coin since its inception. Transact Campus, a payments provider specializing in colleges and universities, announced it has reached the 1-million mark for number of student mobile …

Read More »The NFC Forum Looks to Widen the Range for Contactless Payments

A significantly longer range for contactless transactions could be a reality in the market within the next two to five years, according to news released this week by the NFC Forum, the standards body for near-field communication technology. The current standard for contactless payments is five millimeters, or about one-fifth …

Read More »