Long-time payments executive Frank Bisignano, who has guided payments giant Fiserv Inc. through a tumultuous time in the payments industry, has signed on to lead the company for another five years. Bisignano became chairman of the Brookfield, Wis.-based company in May, following his appointment as chief executive in July 2020. …

Read More »Crime Ring Targets Online Retailers And Other Digital Transactions News briefs from 12/22/22

A fraud ring that appears to be based in Southeast Asia is targeting U.S. retailers and has already committed an estimated $660 million in fraud in stolen laptops, cell phones, computer chips, gaming devices, and other goods just in November, said Signifyd, an online-fraud prevention firm. Signifyd said it has been tracking …

Read More »Paya Partners With 1Retail to Bring Integrated Payments to Small Businesses

Payments provider Paya Inc. has agreed to supply point-of-sale systems supplier 1Retail with technology that enables EMV contactless and stored payments in enterprise resource planning (ERP) software from Acumatica Cloud. The deal provides Paya’s and 1Retail’s mutual customers running the Acumatica ERP platform with a POS system that works in …

Read More »Worldline Adds Splitit as a BNPL Option for Merchants

Global processor Worldline S.A. will make Splitit, a white-label buy now, pay later provider, available to its roster of merchants and marketplaces, starting first in North America. Announced Tuesday, the integration will enable Worldline merchants to offer card-based installment payments within the existing checkout flow. Merchants can use their brand …

Read More »Mobile Fuel Service EzFill Adds a One-Time Payment Service

EzFill Holdings Inc.’s specialty is sending one of its mobile fuel trucks to a driver’s location, thus eliminating the hassle to the driver of having to get to a gas station to fill up the car or a fleet of vehicles. Now, EzFill has launched a new one-time payment service …

Read More »Dealer Pay Joins CDK Program And Other Digital Transactions News briefs from 12/16/22

Dealer Pay, a provider of point-of-sale payment acceptance for auto and truck dealerships, said it has joined the CDK Global Partner Program, which features applications and integrations for automotive dealers. Mastercard Inc. is working with the U.S. International Development Finance Corporation to help support financial institutions and businesses that work with …

Read More »Afterpay Most Used BNPL Option by Gen Z And Other Digital Transactions News briefs from 12/15/22

Afterpay, the buy now, pay later service owned by Block Inc.’s Square, is the one most used by Gen Z consumers—those between 18 and 25 years old—according to a survey from Insights in Marketing, a marketing consultancy, with 58% of them having used Afterpay. Next was Klarna at 44%; Affirm …

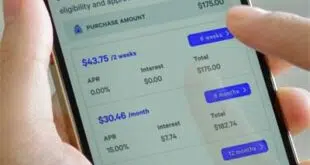

Read More »Is BNPL Risk Overstated? New Data Suggests It Isn’t

One impression of consumers who use buy now, pay later services is that they may not be as financially literate as others. New data from Capterra, a software reviews and selection platform, indicate that picture may not be entirely accurate. In Arlington, Va.-based Capterra’s “2022 Buy Now, Pay Later Survey,” …

Read More »Billtrust Goes Private And Other Digital Transactions News briefs from 12/14/22

BTRS Holdings Inc., also known as Billtrust, said it will go private on Dec. 16 through a merger with an affiliate of EQT X Fund. The business-to-business payments provider went public in January 2021 through a merger with South Mountain Merger Corp., a special purpose acquisition corporation, or SPAC. Payments provider ACI Worldwide said it …

Read More »Facing Fast Growth, Payment Providers Plan a Hiring Blitz in 2023

At a time when many businesses are struggling to fill job openings, payments provider VizyPay LLC announced on Tuesday it is planning a “hiring blitz” in 2023. In preparation for the influx of new employees, the Waukee, Iowa-based processor named Alex Schaeffer director of learning and development and Marj Chaffin …

Read More »