As consumers return to physical stores, Splitit USA Inc., a buy now, pay later provider, announced it is making its service available in-store and including availability with Apple Pay and Google Pay.Fly Now Pay Later, a United Kingdom-based fintech, announced a deal with Cross River Bank in New Jersey that will …

Read More »BlocPal And OneFeather Team to Deliver Services Via Mobile Wallets to Canada’s Indigenous People

As part of its goal to provide unbanked and underbanked consumers affordable digital access to financial services through a single application, BlocPal International Inc. has partnered with OneFeather, a Victoria, British Columbia-based provider of digital services to indigenous people in Canada, to introduce the OneFeather app in that country. The …

Read More »PayPal’s U.S. POS Thrust With Zettle May Have Been ‘Inevitable,’ But It Faces Tough Rivalry

PayPal Holdings Inc.’s decision to bring its Zettle point-of-sale technology to the U.S. market may not surprise observers, but the move presents some formidable challenges, chiefly in the form of the existing competition, some observers say. At the same time, they add, Zettle brings a potent brand that fills a …

Read More »Contactless Parking Expands As ParkMobile Grows Its Presence in North Carolina

ParkMobile LLC Thursday expanded its partnership with parking-lot operator The Car Park to Raleigh, Asheville, and Boone, North Carolina. Previously, The Car Park worked with another payment provider in those cities. The deal also builds on an existing relationship The Car Park has with ParkMobile in Tampa, Boise, Estes Park, …

Read More »COMMENTARY: The Case for Integrated Payments Providers

If there’s a software need for your business—accounting, payroll management, lease portfolio management, and the like— then it’s likely your business is working with several different vendors at any given point during the working day. All the vendors you are working with won’t always be obvious, particularly if you’re working …

Read More »After a Covid Shutdown, a Florida Road Authority Revives Its Visitor Toll Pass Program

Fifteen months after suspending its popular Visitor Toll Pass program due to travel restrictions placed on tourists moving through Orlando International Airport during the Covid pandemic, the Central Florida Expressway Authority on Wednesday rebooted the program. The Visitor Toll Pass, which debuted in May 2019 and was suspended in March …

Read More »Cardknox Is the Latest Player to Adopt QR Codes for Contactless Payments

As the popularity of using quick-response codes for payment at the point-of-sale grows, the trend toward offering the technology to software developers and merchants has gained momentum and now includes small and mid-sized processors. Omnichannel payment gateway Cardknox Development Inc. on Monday became the latest processor to enter the fray, …

Read More »Digital Channels Remain Popular for Bill Pay As Covid Fades, an ACI Study Finds

Consumers’ use of digital channels to pay bills continues to rise even as the Covid-19 pandemic begins to ease, according to a study by ACI Worldwide Inc. In looking at how consumers’ use of digital channels, such as Web sites and mobile apps, has grown during the first half of …

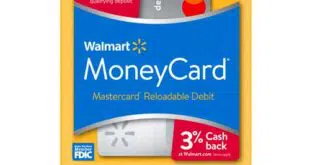

Read More »Through an Expanded Walmart MoneyCard, Green Dot Sharpens Its Focus on Banking Services

Green Dot Corp. has been steadily building its product roster in financial services for the underbanked, with the latest development emerging this week in the form of an expanded focus for the 15-year-old Walmart MoneyCard. The prepaid card, issued by Green Dot Bank and branded by Mastercard or Visa, can …

Read More »Looking to Grow Debit Card Usage, Oxygen Debuts a Tiered Rewards Program

Looking to make debit cards more attractive to consumers by offering incentives that rival those found in credit card rewards and loyalty programs, Oxygen Inc., a San Francisco-based financial-services technology provider, on Wednesday introduced Elements, a tiered rewards and loyalty program for debit card holders. Rewards available through Elements include …

Read More »