Holiday sales were robust in November, giving merchants reason to be optimistic about overall spending for the holiday shopping season, according to the National Retail Federation. Total retail sales in November, excluding automobiles and gasoline, rose 0.77% month-over-month on a seasonally adjusted basis, and 4.24% on an unadjusted basis year-over-year, …

Read More »Software Firm Endava Signs on for an Integration With the Upcoming Paze Wallet

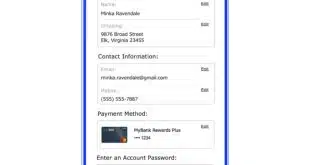

Paze, the upcoming digital wallet backed by banks, has lined up an integration with Endava plc, a software-development firm. Announced Wednesday, the integration, which will be available when Paze launches in 2024, means merchants that use Endava can offer the Paze online checkout. London-based Endava says the simplified checkout will …

Read More »A Benefits Firm Picks Usio for Multiple Payments Assistance

Payments provider Usio Inc. says benefits administrator Genius Avenue will use multiple Usio payments products, including automated clearing house transfers and a prepaid card program, to serve its customers. Announced Monday, the partnership integrates Usio’s payments services with the Genius Avenue platform. Tucson, Ariz.-based Genius Avenue is keen to tap …

Read More »Online Sales And BNPL Transactions Hit Record Highs on Cyber Monday

Online shoppers spent a record $12.4 billion on Cyber Monday, a 9.6% increase from the previous year, according to Adobe Digital Insights. The peak spending period came between 10 p.m. and 11 p.m. Eastern Time, when consumers spent $15.7 million every minute during that hour. Buy now, pay later was …

Read More »Square Holiday Shopping up 14% And Other Digital Transactions News briefs from 11/28/23

Square and Afterpay merchants counted 70 million transactions over the Black Friday-Cyber Monday holiday weekend, up 14% from the same period in 2022, Square said. In-person shopping increased 15% year-over-year. Amendments under consideration by Australia’s national government would impose on digital wallets like Apple Pay and Google Pay the same regulations as those enacted …

Read More »Why Cyber Monday Sales Are Expected to Reach an All-Time High

Holiday shoppers are projected to spend a record $12 billion to 12.4 billion online on Cyber Monday 2023, according to Adobe Analytics. Cyber Monday caps off the first weekend of the traditional holiday shopping season that begins Thanksgiving Day. Overall, Adobe projects online sales for the five days between Thanksgiving …

Read More »3-D Secure Use Drives Down CNP Fraud Rates, Report Finds

Merchants and financial institutions that use 3-D Secure to help vet online transactions in markets that require its use see fraud rates that are three to six times lower than for all card-not-present transactions. That’s one finding from a Outseer-sponsored report completed by the research and consulting firm Datos Insights. …

Read More »Stripe Partners With Fraud Fighter Vesta And Brings Tap-to-Pay on iPhone to Alaska Airlines

Vesta, a fraud-prevention provider for e-commerce merchants, said it will integrate Stripe Inc.’s Radar risk scores and Stripe Connect, which enables businesses to facilitate purchases and payments between third-party buyers and sellers, into its Payment Guarantee platform. The Stripe Radar integration will help Vesta’s client merchants increase transactional approval rates …

Read More »2024 Juniper Trends Range from Account-to-Account Payments to Value-Added Services Atop FedNow

As 2023 winds down, Juniper Research is out with its top 10 trends for payments and fintechs in 2024. Chief among them is a challenge to cards in e-commerce and funding for wallets through account-to-account payments. Closely related is the prospect for FedNow, the nascent real-time payment service from the …

Read More »Eye On Stadiums: Shift4 Adds the Miami Dolphins; Oakview Group Partners With Oracle

Shift4 Payments Inc. extended its reach in stadium payments Wednesday by partnering with the National Football League’s Miami Dolphins and Hard Rock Stadium to process payments for ticket sales for Dolphins games and other events at the stadium. The deal builds on Shift4’s integration with Ticketmaster Entertainment LLC, which was …

Read More »