More than 252 million iPhone owners globally use Apple Pay, a figure that equates to 31% of the active iPhone base, says Loup Ventures, a Minneapolis-based venture-capital firm. A year ago, the figure was 25%. That growth mostly is coming from international consumers, who Loup Ventures says account for 85% …

Read More »i3 Verticals Reports $84.5 Million in Revenue and other Digital Transactions News briefs from 8/10/18

Payments provider i3 Verticals Inc. reported revenue of $84.5 million in its fiscal third quarter ended June 30, a 27.5% increase from $66.3 million a year ago. It had a loss of $655,000, compared with net income of $887,000 last year. This marks the first earnings results for the company …

Read More »CPI Card Group’s Results Improve Amid Double-Digit Prepaid Card Revenue Growth

Payment-card maker CPI Card Group said Thursday that new sales from an existing customer boosted its U.S. prepaid debit card revenue 26% in the second quarter. Littleton, Colo.-based CPI also reported that sold its United Kingdom business to private-investment firm SEA Equity for $4.5 million. With revenue of $15.4 million …

Read More »Worldpay Finishes First Full Quarter of Combined Operations With $1 Billion in Revenue

Having completed its first full quarter of operation on June 30, Worldpay Inc. on Thursday reported just over $1 billion in net revenue for the period from business lines that include merchant processing, technology services, and card-issuer support. That’s up 11% from what Vantiv Inc. and Worldpay Group plc would …

Read More »57% of In-Store Transactions Are Chip-on-Chip and other Digital Transactions News briefs from 8/9/18

Citing data from the global payment card networks, the U.S. Payments Forum reported in its latest update on the conversion from magnetic-stripe to EMV chip card payments that approximately 57% of in-store card transactions are now “chip-on-chip,” meaning an EMV point-of-sale terminal read an EMV card. Also, acceptance of contact …

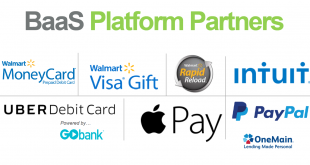

Read More »With Some Fast-Growing Programs, Green Dot Hopes Its BaaS Becomes a Whale

Green Dot Corp. executives played up their “banking-as-a-service” platform Wednesday as the company reported strong second-quarter growth in most of its business lines, but they said little about the support they provide for Apple Inc.’s Apple Pay Cash service. Pasadena, Calif.-based Green Dot supplies the virtual prepaid card that customers …

Read More »Fresh From Its IPO, EVO Payments Looks for Expansion Opportunities Abroad

EVO Payments Inc. is hunting for new international markets as it continues to see growth in its U.S.-based business with independent software vendors, company executives said Wednesday during the merchant processor’s first earnings conference call as a public company. Founded in 1989 as an independent sales organization, Atlanta-based EVO in …

Read More »From Spear Phishing to POS Malware, a Security Expert Lays Out His Six Most Worrisome Threats

Malicious attacks on payments systems come in a bewildering array of shapes and sizes, making it a nettlesome problem figuring out which types of attack require the most defensive resources. Yet, the stakes could be highest in the United States, where the average cost per breach, at $225, is one …

Read More »GM Enables More In-Car Payments Options and other Digital Transactions News briefs from 8/8/18

Flow, a cross-border e-commerce platform, has added a cryptocurrency option through an arrangement with BitPay, a cryptocurrency exchange. Through a so-called marketplace update, General Motors Co. is enabling in-dash fuel payments in select Buick models at Exxon Mobil stations. The capability is expected to come to other GM makes, 2017 …

Read More »Microsoft Integrates Microsoft Pay With Masterpass In Its Latest Bid to Enhance the Wallet

Microsoft Corp. continues to make enhancements to Microsoft Pay in a highly competitive market for digital wallets. This week, the computing giant said Microsoft Pay has been integrated with Masterpass, the online wallet from Mastercard Inc. that lets consumers pay with stored credentials from a variety of payment providers. “We …

Read More »