Having closed on two key acquisitions, the big processor Shift4 Payments Inc. is looking to expand its business in Canada and Europe and build on its new beachhead in sports arenas, top management said early Tuesday. With its $100-million deal last fall to acquire Appetize Technologies Inc. from SpotOn Transact …

Read More »You Can Attribute Google Pay’s Demise to Weak Market Share And Google Wallet’s Popularity, Experts Say

Alphabet Inc.’s decision to discontinue Google Pay in the U.S. market, including its peer-to-peer payments capability, effective in June is not entirely an unexpected move, experts say, as the app has a more popular sibling in Google Wallet. And, they note, it lacks the market share of competing digital wallets. …

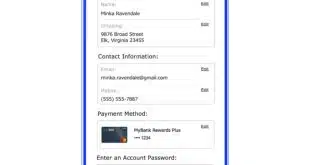

Read More »Good News for Paze: 44% Would Use a Bank-Provided Digital Wallet

When it comes to online checkout, consumers like using digital wallets. Seventy-two percent of them value digital-payment tools like digital wallets to make the online checkout easier, says Paze in its inaugural Paze Pulse report. Paze is an upcoming digital wallet from Early Warning Services LLC. Backed by seven large …

Read More »Capital One May Acquire Discover. What Could That Mean?

Capital One Financial Corp. may be on the brink of acquiring Discover Financial Services, if two news reports are accurate. The Wall Street Journal and Bloomberg.com separately reported on Monday a deal between the two credit card juggernauts is in the offing, with The Journal reporting an announcement could come …

Read More »FIS’s Pay by Bank Path And Other Digital Transactions News briefs from 2/14/24

FIS Inc. said it is working with Banked, an open-banking provider, to develop new pay by bank services for businesses and consumers. Gateway provider Trice Technologies Inc. said it is a technology provider and real-time payments gateway for the RTP network from The Clearing House Payments Co. LLC. Web services and payments provider GoDaddy …

Read More »Radial Adds Link Money’s Pay by Bank for Account-to-Account Payments

E-commerce platform Radial Inc. is giving its merchants a new payment option that bypasses traditional credit and debit card payments and instead relies on account-to-account transfers. Dubbed Pay by Bank, the service was developed by Link Financial Technologies Inc., which does business as Link Money, an open-banking platform. King of …

Read More »ABA Formalizes BIN Administration Handoff to Long-Term Partner CUSIP

CUSIP Global Services announced late Wednesday that it will be taking over day-to-day operations of the administration of the issuer identification number system from the American Bankers Association. The change is not monumental as CUSIP has a long history of managing numbering programs for the financial services industry. The ABA …

Read More »Payroc Beefs Up Its Presence in Canada With Its Deal for SterlingCard

Payments-platform provider Payroc LLC has expanded its footprint in Canada through its acquisition of SterlingCard Payment Solutions Inc., a provider of retail and e-commerce payment solutions, for an undisclosed sum. Tinley Park, Ill.-based Payroc announced mid-day Tuesday it had closed on the deal. The acquisition enables Payroc to offer a …

Read More »PSCU/Co-op Debuts a BNPL Service for Credit Unions

Credit union service organization PSCU/Co-op Solutions released its buy now, pay later service to credit unions, enabling their cardholders to make installment payments on their card-based purchases. PSCU/Co-op, which merged Jan. 1, says cardholders whose credit unions enroll in the service can choose qualifying transactions to pay back in installments. …

Read More »Fiserv Logs Robust Results in Its Merchant Unit As Its Clover Tech Surges Ahead

Fiserv Inc., already a behemoth in merchant processing, is preparing to straddle its twin pillars of acquiring-bank relationships, on the one hand, and its own acquiring operations through a Georgia bank charter, on the other. The charter, which the big processor applied for last month, has “a very specific purpose,” …

Read More »