The processor Nuvei said it has expanded its global clearing and settlement services into the U.S. and Canadian markets. Mastercard Inc. reported second-quarter net revenue of $8.1 billion, up 17%, with net income of $3.7 billion, a 14% rise. Lightspeed Commerce Inc. reported June-quarter revenue of $304.9 million, up 15% from the same period …

Read More »Card 91’s AI Gambit and other Digital Transactions News briefs from 7/28/25

Card91, a payments-software platform based in India, announced merchant onboarding and verification technology based on artificial intelligence and aimed at banks and payment aggregators. FreedomPay’s gateway will support e-commerce and in-store payments for restaurants as part of an agreement with Deliverect, a provider of commerce technology for fast-food chains, including Taco …

Read More »Nuvei Looks to Boost Card Authorizations for North American Merchants

With merchants growing more heated in their opposition to card-acceptance costs, processors are looking for strategies that could help sellers gain from improvements in card authorizations. An example emerged early Thursday with news from the big Canadian processor Nuvei Corp. that it has introduced a pair of technologies it says …

Read More »A Suit Is Dismissed Claiming Apple, Mastercard, And Visa Worked to Hold Fees in Place

An Illinois merchant’s allegations that Apple Inc., Mastercard Inc., and Visa Inc. worked to artificially maintain pricing by agreeing to funnel Apple Pay transactions via the two card networks was dismissed this week by a judge in the U.S. District Court for the Southern District of Illinois. Filed in December …

Read More »Helcim’s Latest Smart POS Terminal and other Digital Transactions News briefs from 7/11/25

The point-of-sale provider Helcim Inc. launched Smart Terminal, a handheld POS device aimed at smaller merchants. Under a new agreement, acquirer Sona said it will offer merchant services to businesses that are members of Vancity, said to be one of Canada’s largest credit unions. Sona was acquired last year by Celero Commerce. The law …

Read More »Paze Lines Up Payfinia to Expand Its Digital Wallet to Credit Unions

Paze, the digital wallet from Early Warning Services LLC, says it is working with Payfinia, a unit of banking-services provider Tyfone Inc., to expand its reach. Payfinia, formed by Tyfone in 2024 to provide real-time payments technology, has helped line up Star One Credit Union, a Sunnyvale, Calif.-based financial institution, …

Read More »A U.K. Regulator Throws an Interchange Obstacle at Mastercard And Visa

A ruling in the United Kingdom could imperil the validity of multilateral interchange fees in the United Kingdom and Ireland assessed by Mastercard Inc. and Visa Inc. A U.K. tribunal Friday ruled the fees infringe on competition law. The Competition Appeal Tribunal ruled the fees infringe on prohibitions to restrict, …

Read More »LendingClub’s New Debit Card and other Digital Transactions News briefs from 6/19/25

LendingClub Corp. said its LendingClub Bank unit introduced LevelUp Checking, which includes a debit card. LendingClub specializes in personal loans. LevelUp Checking users with one of these personal loans could receive up to 2% of their monthly payment in cash back when making on-time payments from the checking account. HungerRush, a …

Read More »Millennials Favor Payment Options That Match Their Mobile-First Lifestyles

When it comes to payments, Millennials want options that match their mobile-first lifestyle, such as mobile wallets, says a study by payments platform provider PXP Financial Ltd. Overall, 56% of Millennials—generally those born between 1981 and 1996—use a mobile device daily. Apple Pay is one of the most popular mobile …

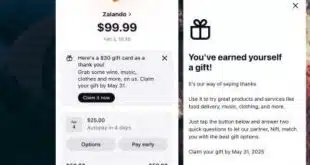

Read More »Eye on BNPL: Klarna Enlists Nift for Unique Offers; Dick’s Sporting Goods Renews Affirm

Buy now, pay later specialist Klarna AB is working with gift card platform Nift to boost customer engagement while retailer Dick’s Sporting Goods says it will renew its buy now, pay later deal with Affirm Inc. In the partnership announced Thursday with Nift, Klarna will be able to create gift …

Read More »