Capital One has partnered with fraud-detection firm Signifyd Inc. to raise authorization rates and reduce mistakenly declined transactions on Cap One credit card transactions.The Internal Revenue Service on Friday sent more than 430,000 Advance Child Tax Credit payments via same-day ACH on the automated clearing house network, according to Nacha, the governing body …

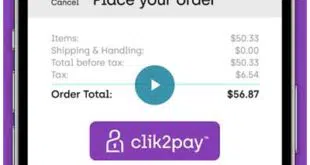

Read More »Startup Clik2pay Enables Consumers to Tap Their Bank Account For Online Purchases

Seeking to provide online merchants with a lower-cost payment option and consumers a better user experience, a 3-year-old, Toronto-based payment-service startup called Clik2pay is enabling Canadian consumers to pay for online purchases directly from their bank accounts at participating merchants. The new payment option, which launched Thursday, leverages the Interac …

Read More »BNPL Consumers Are Not Shy About Using Credit Products, a TransUnion Report Finds

New research suggests buy now, pay later users may not be shunning traditional retail credit products in favor of the installment-payment option. That’s one finding from TransUnion LLC’s “Understanding the Evolving Point-of-Sale” report released Thursday. The data show that 76% of the point-of-sale financing applicants had a retail card in …

Read More »Repay Teams with Veem for Cross-Border Payments and other Digital Transactions News briefs from 9/23/21

Payments-technology provider Repay Holdings Corp. has agreed to partner with business-to-business funds-transfer fintech Veem Inc. to increase cross-border payment options. At the same time, Veem will deploy Repay’s business-to-business virtual card and acquiring platform.InsurCard, a payment processor specializing in health care, launched a Mastercard debit card for persons who have received a …

Read More »Eye on BNPL: Affirm Combines Repayment Options And SeaWorld Offers Uplift Installments

As the buy now, pay later payment option continues to permeate commerce, Affirm Inc. fine tunes its repayment options and Uplift hooks SeaWorld as a client. San Francisco-based Affirm says its new Adaptive Checkout gives consumers the option to pay in biweekly or monthly installments. The service will dynamically present a …

Read More »Chevron Picks P97 for App Updates and other Digital Transactions News briefs from 9/22/21

Chevron Products Co. said it is working with mobile-payments technology provider P97 Networks Inc. to enhance the company’s mobile apps for both Chevron and Texaco customers.Mercator Advisory Group’s “18th Annual U.S. Closed-Loop Prepaid Cards Market Forecast 2020-2025” found that closed-loop prepaid card loads dropped 14% because of the pandemic, but are expected …

Read More »One Inc. Begins to Speed Insurance-Claims Payouts for Amerisure

Faster-payments providers have long identified insurance-claims payouts as a ripe market, and the business took big step in that direction with the announcement early Monday that the insurance carrier Amerisure has begun implementing ClaimsPay, a digital-payments platform from the 9-year-old fintech One Inc. The four-stage implementation is expected to replace …

Read More »Priority Completes Finxera Deal and other Digital Transactions News briefs from 9/20/21

Payments provider Priority Technology Holdings Inc. completed its acquisition of Finxera Holdings Inc., a provider of banking-as-a-service software. Terms of the deal, which was announced in March, were not announced.Payment-fraud prevention provider Inetco Systems Ltd. launched BullzAI, a single technology combining a Web application firewall with a real-time fraud-detection and blocking system.The Tampa Hillsborough …

Read More »Contactless Payment Rises—And So Do Back-to-School Purchases—PSCU Report Shows

Contactless credit card transactions caught up to their debit counterparts as a percent of volume in August, with 17% of total card-present volume, as tracked in the monthly PSCU Payments Index, attributed to the payment form. That matches the share for contactless debit transactions. PSCU, a St. Petersburg, Fla.-based credit …

Read More »The U.K.’s Curve App Launches a Buy Now, Pay Later Feature Called Curve Flex

Hot trends tend to spin off related innovations, and now it looks like buy now, pay later is no exception. The London-based fintech Curve OS Ltd. on Thursday unveiled Curve Flex, a service that lets users convert any Curve transaction into an installment plan with the swipe of a button …

Read More »