Paze, an online wallet still in development, will be available to merchants using GoDaddy Inc.’s Web services. Paze is available for testing to select U.S. businesses on the GoDaddy platform. In March, at the announcement of Paze, Early Warning Services LLC, its developer, said full availability would arrive this autumn, …

Read More »Worldpay’s Transit Move And Other Digital Transactions News briefs from 10/10/23

The processor Worldpay said it will work with Masabi, a provider of technology for transit-fare payments, to offer an EMV platform for what the pair call “transit agencies of all sizes.” Health-care payments specialist RevSpring unveiled new features of its Engage IQ platform that includes updated messaging, the ability to use graphics in email …

Read More »Slake’s Delivery App Supports Crypto Payments; Visa’s Billions in Crypto Volume Since 2021

Slake IT LLC on Monday launched a food-delivery app that enables consumers to pay for orders using cryptocurrency in addition to credit cards. The company, which is supporting the Ethereum platform to enable crypto payments, has partnered with drivers of multiple food-delivery companies, including DoorDash, Uber Eats, and Grubhub, to …

Read More »COMMENTARY: Why the Credit Card Competition Act Falls Short

The Credit Card Competition Act (CCCA) looks to be headed for a vote before the end of the year, spurred in part by Sen. Dick Durbin’s recent urging that it be brought to the Senate floor. While the Illinois Senator is of the mind it will help increase industrywide competition …

Read More »Rainforest Raises $11.75 Million And Other Digital Transactions News briefs from 10/9/23

Rainforest, an Atlanta-based platform for embedded payments, has closed on an $11.75-million seed funding round led by Accel. Beverly, Mass., has contracted with Passport for support of mobile payments for parking in the town. Passport claims more than 800 cities and other entities using the app. Instant Financial, a provider of earned-wage …

Read More »Pricing Rules Are at the Heart of a New Class-Action Lawsuit Against PayPal

A new lawsuit filed Thursday against PayPal Holdings Inc. alleges the online powerhouse uses illegally anticompetitive policies that increase costs for consumers. Filed by Hagens Berman, a law firm that specializes in class-action litigation, the suit contends that PayPal prohibits merchants that work with it to offer pricing discounts when …

Read More »COMMENTARY: Why Stripe Will Dominate the New Era of Processing

In North American payments, full-suite processors—those that perform direct authorization and interchange for branded networks, including Visa and Mastercard—belong to an exclusive club. But many still rely on what would otherwise be considered commercially obsolete infrastructure. All of them grew up in a world where magstripe was leading edge, payment …

Read More »Streamline One Launches And Other Digital Transactions News briefs from 10/6/23

Property-management technology provider Streamline launched Streamline One, a set of technologies including reservation verification and rental-payments acceptance. Sightline, a specialist in digital casino payments, launched Deposit+, a service that credits to the casino’s bank account cash sitting in slot machines and kiosks for immediate access. As part of its entry into …

Read More »Galileo Brings BNPL to Small Businesses Through Mastercard Installments

Galileo Financial Technologies LLC has expanded its buy now, pay later offering to small businesses for business-to-business purchases. The offering is available to lenders and fintechs using Galileo’s technology. They will have the option to customize the total number of installment payments for BNPL loans, according to Galileo. Galileo, which …

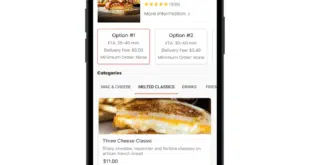

Read More »Small-Screen Shopping Set To Dominate 2023 Holiday Spending

One of the first forecasts for the upcoming 2023 holiday shopping period predicts that mobile devices will overtake desktop ones for e-commerce for the first time. Adobe Inc., in its Nov. 1-to-Dec. 31 holiday-shopping forecast, released Thursday, forecasts that U.S. online holiday sales will reach $221.8 billion, a 4.8% increase …

Read More »