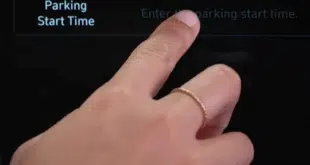

Step one for Hyundai Pay, the in-car payment service debuting in the 2024 Kona crossover, is enabling payments for parking while sitting in the driver’s seat. Step two is broadening its capabilities and making it an integral part of the vehicle, Olabisi Boyle, Hyundai Motor North America vice president of …

Read More »A Top Fed Official Points to Real Time Payments Progress While Eyeing Stablecoins Skeptically

The Federal Reserve seeks to work closely with private-sector instant-payment services and plans to carve out a regulatory role to govern developments in stablecoins, a top official at the Fed said Friday. The remarks come in the wake of the Fed’s launch in July of its FedNow real-time payments network. …

Read More »Zip Eyes Expansion And Other Digital Transactions News briefs from 9/11/23

Buy now, pay later specialist Zip Co Ltd. said it is working with Primer, a payments and commerce provider, to expand and optimized its payments stack. The troubled cryptocurrency exchange FTX is seeking to reclaim millions in payments it made to celebrities and sports personalities prior to its November bankruptcy filing. Merchant services provider PayBright named …

Read More »The CFPB Eyes Tech Firms’ Role in Governing Tap-to-Pay

The Consumer Financial Protection Bureau late Thursday released a report raising questions about the part restrictions imposed by big technology firms like Apple Inc. and Alphabet Inc’s Google subsidiary may play in hampering innovation, consumer choice, and the growth of open and decentralized banking and payments in the U.S. The …

Read More »Commentary: BNPL May Be All the Rage, But Embedded Lending Is a Better Option for Merchants

According to Juniper Research, 360 million people worldwide used Buy Now, Pay Later (BNPL) in 2022. With such an expansive consumer base, BNPL has also become an effective tool for merchants to attract new customers and increase conversion rates. However, the widespread use of BNPL has raised concerns regarding transparency …

Read More »Square Outage Disrupts Transactions And Other Digital Transactions News briefs from 9/8/23

Block Inc.’s Square and Cash App units began experiencing system outages late Thursday, according to news reports. Cash App’s outage reportedly affected peer-to-peer payments, cash-ins, and cash card transactions. At Square, engineers reported early Friday they were deploying a solution. Point-of-sale system maker iPOS Systems has enabled Tap to Pay on iPhone for U.S. …

Read More »Eye on Fraud: Global Ransomware Attacks Soar to a Monthly High; Cyber Attacks Hit Hospitality Merchants

Monthly global ransomware attacks hit an all-time high in March, totaling 460. That’s a 62% increase from the same period a year earlier, and a 91% increase from the prior month, according to the fall edition of Visa Inc.’s 2023 Biannual Threats Report. Leading causes for ransomware attacks are criminals …

Read More »Eye on Cannabis: POSaBIT POS 2.0 Debuts; Organic Payment Gateways’ New Program

Though not as credit and debit card friendly as some industries, the legalized cannabis industry continues to create opportunities for payments companies. Among the latest developments are the release of POSaBIT Systems Corp.’s latest point-of-sale system and a new program from Organic Payment Gateways. Bellevue, Wash.-based POSaBIT says its POSaBIT …

Read More »Cantaloupe Volume up 14%And Other Digital Transactions News briefs from 9/7/23

Cantaloupe Inc., a payments provider for the vending and self-service industries, reported it processed $703.5 million in volume in the June quarter, up 14% year-over-year, on 278.6 million transactions, up slightly from 274.6 million. It collected $64.2 million in revenue, an 11% rise. In a letter to shareholders, Innovative Payment Solutions …

Read More »Hyundai Jumps Into In-Car Payments With Hyundai Pay

Hyundai Motor North America has launched Hyundai Pay, an in-car payments app that will enable drivers to find and pay for products and services using stored credit card information and the vehicle’s touchscreen. Hyundai owners will initially be able to use the app to locate, reserve, and pay for parking …

Read More »