Processor Shift4 Payments Inc. said it will integrate payment-issuance technology from payments provider ConnexPay for online travel agencies operating in the United Kingdom and Europe. The Dow Jones Industrial Average gained 1,100 points in early trading Wednesday as at least five payments companies—including Visa Inc. and American Express Co.—reached all-time highs. The skyrocketing market …

Read More »Mastercard And Bill Payments and other Digital Transactions News briefs from 10/28/24

Mastercard Inc. has launched Bill QKr, a service supporting merchants and acquirers in accepting and more quickly processing card-based bill payments. 2C2P, AXS, CardUp, Curacel, and FitBank are among the first to adopt the new service. Real-time cross-border payments platform Nium launched Nium Verify, a service the company says can verify both business …

Read More »The CFPB Releases Its Data Privacy Rule for Open Banking

The Consumer Financial Protection Bureau has finalized its personal financial data-rights rule aimed at governing the sharing of consumer data through open banking. The new rule, released early Tuesday, will require financial institutions, credit card issuers, and other financial providers to share data at a consumer’s direction with companies offering …

Read More »Fiserv Posts Growth As New Tech And New Initiatives Start to Kick in

Fiserv Inc., one of the nation’s biggest processors, put up some notable growth numbers in the September quarter despite its size. How long it can maintain that momentum may depend on its ability to release new services and build on recent initiatives such as its SMB Bundle and Cashflow Central, …

Read More »Visa Tweaks Visa Direct Line up and other Digital Transactions News briefs from 10/18/24

Visa Inc. has restructured its money movement services under the Visa Direct portfolio, which now includes Visa B2B Connect, Currencycloud, Yellowpepper, and Visa Direct. Cash App, the peer-to-peer payment service and wallet from Square, said Lyft ride-share users can now pay for fares with Cash App. Truist Financial Corp. launched its Electronic …

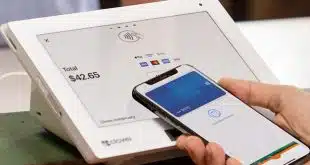

Read More »Apple Pay’s 10th Anniversary and other Digital Transactions News briefs from 10/17/24

Apple Inc. which is celebrating the 10th anniversary of the introduction of Apple Pay, said the payments service is now supported by more than 11,000 banks and networks globally and has attracted “hundreds of millions” of users in 78 markets around the world. Buy now, pay later provider Klarna AB payment options …

Read More »Eye on Software: Fear Free Inks a Gravity Tie in; Weave’s Tweaks for Vet Practices

Two payments providers, in separate developments, are fine- tuning their services for veterinary-practice software makers. Gravity Payments Inc. has an integration with Fear Free LLC, a software developer, and Weave is updating its software for veterinary clinics. Broomfield, Colo.-based Fear Free says it will offer Gravity’s payment option with its …

Read More »Plaid Collaborates with Ansa and other Digital Transactions News briefs from 10/8/24

Open-banking platform Plaid is collaborating with digital-wallet provider Ansa to offer a pay-by-bank capability to restaurants and other merchants, with wallet transactions handled via the automated clearing house. Payments-technology platform Modern Treasury launched widened support for connectivity to FedNow and The Clearing House’s RTP network for real-time payments, as well as other moves to …

Read More »Paysafe’s Latest GIG of Holiday Gift Budgets and other Digital Transactions News briefs from 10/7/24

Paysafe Ltd. will process transactions for clients of Gaming Innovation Group in North America, the United Kingdom, continental Europe, and Latin America that have adopted Gaming Innovations’ CoreX player-account management system. Silverblaze, a developer of customer-engagement software for utility companies, will adopt billing and payment technology from Kubra and has joined …

Read More »Priority’s Bill Pay Change and other Digital Transactions News briefs from 10/3/24

The Priority Commerce unit of Priority Technology Holdings Inc. has replaced the subscription billing model for Plastiq, its bill pay service, with a transaction fee per use. It also made all formerly premium subscription tools available to all users. The Small Business Index from the processor Fiserv Inc. indicates small-business sales and total …

Read More »