Fresher data flowing directly from payments platforms could mean more effective remedies against chargebacks, some observers say. On Tuesday a major risk-management firm acted on that theory with a service that allows sellers to factor in information regarding chargebacks and disputes that flow through integrations with PayPal Holdings Inc. and …

Read More »Fitli Taps Usio And Other Digital Transactions News briefs from 9/13/23

Fitli, an independent software provider for fitness professionals, has selected Usio Inc. for payments processing. Prepaid card specialist Blackhawk Network has agreed to launch “Gift Card Malls” inside airport and casino shops operated by WH Smith North America. Three unnamed central banks are testing a method from international money-transfer platform Swift to enable interoperability …

Read More »Eye on Processors: Wix Debuts Tap to Pay on Android; Adyen Issues 2 Billion Tokens

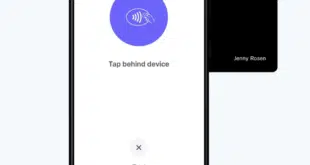

E-commerce platform Wix.com Ltd. looks to make it easier for its merchants with stores to accept physical payments with the debut of Tap to Pay on Android. The technology, coming from Stripe Inc., means merchants can accept contactless payments with a regular Android smart phone and no additional hardware. Tap …

Read More »Eye on Fraud: Global Ransomware Attacks Soar to a Monthly High; Cyber Attacks Hit Hospitality Merchants

Monthly global ransomware attacks hit an all-time high in March, totaling 460. That’s a 62% increase from the same period a year earlier, and a 91% increase from the prior month, according to the fall edition of Visa Inc.’s 2023 Biannual Threats Report. Leading causes for ransomware attacks are criminals …

Read More »Mastercard Denies Rate Bump Assertion And Other Digital Transactions News briefs from 9/5/23

Mastercard Inc. denies an assertion it intends to raise interchange rates in October following an Aug. 30th story in The Wall Street Journal about interchange rate adjustments expected from Mastercard and Visa Inc. in October and April. Mastercard said the article relied on a report from an advisory firm that is advocating for legislation that …

Read More »Commentary: With Quantum Computing, Time is Short. Start Preparing Now

In somewhat simple terms, quantum computing uses quantum mechanics – an area of physics that examines the behavior of particles at a microscopic level – to solve complex problems more rapidly than on conventional computers. It includes elements of physics, computer science, and mathematics. For the purpose of this …

Read More »New SEC Rule Ups the Ante on Data Breach Disclosures

With the Securities and Exchange Commission mandating public companies victimized by a cyberbreach publicly disclose the breach, businesses need to be more diligent in keeping out cybercriminals, as disclosure of such information can subject them to greater scrutiny and potential liability. The rule, which the SEC passed in July, requires …

Read More »Affirm’s Revenue up, Though Loss Broadens And Other Digital Transactions News briefs from 8/25/23

Buy now, pay later provider Affirm Inc. posted fiscal fourth quarter revenue of $445.8 million, up 22.4% from $364.1 million in the quarter ended June 30, 2022. Its quarterly loss of $206 million broadened from $186.4 million a year ago. For the full year, Affirm had $1.588 billion in revenue, up 17.7% …

Read More »Fiserv’s Open Banking Move with Akoya Eases Secure Credential Sharing

Fiserv Inc. is working with data aggregator Akoya LLC to enable consumers to share their financial data with fintech and third-parties with which they do business in a way that doesn’t expose a consumer’s full banking credentials. The partnership will provide Fiserv with access to consumer data from Akoya’s network …

Read More »BNPL for Workplace Training And Other Digital Transactions News briefs from 8/24/23

OSHA Outreach Courses, which provides workplace training services to employers and employees, said it has added a buy now, pay later option to pay for its instructional offers. Shift4 Payments Inc. has been named the official payment processor for the Cleveland Cavaliers of the National Basketball Association. Shopmium, a cash-back shopping …

Read More »