Clowd9, a cloud-based payment-processing platform, said it will use 3-D Secure issuer services from Netcetera to authenticate transactions and for access control services. Mastercard Inc. introduced its Mastercard Artist Accelerator program, which aims to assist fledgling music artists through nonfungible tokens and other Web3 technologies.

Read More »Why the FTC Isolated Mastercard With Its Pre-Christmas Consent Order

When the Federal Trade Commission announced two days before Christmas it had leveled a preliminary consent order against Mastercard Inc. to correct what the agency saw as roadblocks the card company had erected against routing online debit transactions to competing networks, the move may have surprised at least some observers. …

Read More »ID Theft Hits Black Victims’ Wallets Especially Hard, New Research Says

Identity theft is a national scourge, but initial research findings released early Wednesday indicate that scourge impacts Black victims far more than it does other segments of the U.S. population. The impact can be measured by the dollar losses ID theft victims suffer, according to the report. In one example …

Read More »Inflation’s Impact On Remittances And Other Digital Transactions News briefs from 1/3/23

The number of cryptocurrency hacks globally reached 190 last year, setting a new annual record and exceeding 2021’s total by 44%, according to Comparitech. The value stolen totaled $3.57 billion, exceeding the combined total for 2019, 2020, and 2021. Some 82% of senders of remittances across borders said the cost of living has risen …

Read More »MoneyGram Links to CellPay for Bill Pay And Other Digital Transactions News briefs from 12/28/22

MoneyGram International Inc. announced a partnership with bill-payment platform CellPay to expand bill-pay options for MoneyGram users while expanding acceptance for MoneyGram’s service to more than 30,000 billers. Some 3.46% of U.S. consumers opened a new credit card in November, down from 3.7% in November 2021, according to the December 2022 …

Read More »Fraud on P2P Networks Hits 12% of Bank Customers in the U.S., J.D. Power Finds

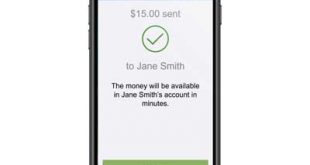

Some 12% of U.S. customers have lost money to fraud on a peer-to-peer payment network, while 11% have seen it happen to a family member, according to survey results released earlier this month by J.D. Power. The networks cited by the respondents were Zelle, Venmo, and PayPal. For the survey, …

Read More »Mechanics Adopts Finastra RTP Service And Other Digital Transactions News briefs from 12/21/22

Payments-technology provider Finastra said Mechanics Cooperative Bank, a financial institution with $645 million in assets, has adopted the Finastra Payments To Go platform to offer real-time payments via The Clearing House Payments Co. LLC and later through the Federal Reserve’s FedNow network. Digital-security provider IronVest Inc. launched what it calls a “super app” for …

Read More »Study: Peer-to-Peer Payments Are Key To Financial Institutions’ Payment Strategies

As financial institutions look to revamp their payment strategies, peer-to-peer payments are expected to play a key role, says a report from Cornerstone Advisors. During the past three years, nearly 30% of community-based financial institutions have replaced their P2P service or selected a new one, and about one in five …

Read More »Zelle Users Are More Profitable for Financial Institutions, says an Early Warning Study

Customers new to using Zelle, the peer-to-peer payment network operated by Early Warning Services LLC, have higher levels of engagement with their financial institutions than customers not using Zelle. That’s according to a recent study conducted by Early Warning and Curinos, a provider of data and technology technologies to financial …

Read More »Wedge Joins Fiserv AppMarket And Other Digital Transactions News briefs from 12/19/22

Wedge Financial Inc. said its app, which lets users spend funds from multiple fiat accounts and assets using a single card, has joined Fiserv Inc.’s AppMarket. Work at the New York Fed under an initiative called “Project Cedar” means the United States has officially moved from the “research” phase to the …

Read More »