Canada-based BMO Financial Group launched PaySmart in the U.S. market. PaySmart is a credit card feature that lets users divide transactions of $100 or more into installments over three, six, or 12 months at a monthly fee. Travel payments network UATP has added buy now, pay later platform Floa as another installment payment option. …

Read More »Eye on Fraud: AI’s Looming Role This Holiday Season; Trulioo’s New Anti-Fraud Tool

With just 52 days until the traditional start of the holiday shopping season post-Thanksgiving, consumers and criminals are gearing up for a busy period. A new report from ACI Worldwide Inc. forecasts that synthetic-identity fraud and artificial-intelligence use will be a big lump of coal for merchants. Meanwhile, identity platform …

Read More »Plaid Collaborates with Ansa and other Digital Transactions News briefs from 10/8/24

Open-banking platform Plaid is collaborating with digital-wallet provider Ansa to offer a pay-by-bank capability to restaurants and other merchants, with wallet transactions handled via the automated clearing house. Payments-technology platform Modern Treasury launched widened support for connectivity to FedNow and The Clearing House’s RTP network for real-time payments, as well as other moves to …

Read More »CellPoint’s PayU GPO Alliance and other Digital Transactions News briefs from 10/2/24

CellPoint Digital, a payments-orchestration platform, announced an alliance with PayU GPO, a platform for alternative payment methods operating in more than 50 markets globally. In related news, payments-orchestration platform Transcard said it now supports payments globally through multiple currencies in an effort to smooth payments for financial companies operating worldwide. Duck Creek …

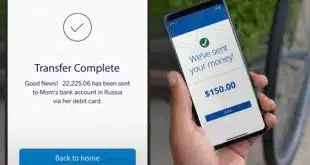

Read More »Two P2P Payments Providers Clear up What ‘Unauthorized’ Means

A fresh report from Consumer Reports finds that two of the four peer-to-peer payments companies it evaluated have cleared up the definition of “unauthorized” transactions pertaining to fraud. The publication last reviewed Apple Cash, Cash App, Venmo, and Zelle in 2022. The issue of what is an unauthorized P2P transaction gained …

Read More »PrePass Marks Integration and other Digital Transactions News briefs from 9/30/24

PrePass, a platform for highway toll payments, said its services can be accessed via an integration with the Motive Marketplace, a platform featuring artificial-intelligence capabilities. A survey of 2,600 consumers in the U.S. market and in seven other countries revealed 61% have cut back on using digital payments or otherwise changed their …

Read More »Payments Rank High on Community Banks’ To-Do Lists

Against a backdrop of continuing industry consolidation, community banks see digital payments as a key competitive weapon, according to newly released survey data from Bank of New York Mellon Corp. “Nearly 30% of those polled indicated that launching new technology services focused on efficiency and security, such as instant payments, …

Read More »Bluefin And Moneris Move to Enhance Point-to-Point Encryption for Merchants

Bluefin Payment Systems LLC expects its deal with processor Moneris Solutions Corp. will significantly streamline Canadian merchants’ payment card security through what the parties say is an enhanced point-to-point encryption solution. Under the terms of the deal, announced last week, Moneris will include point-to-point encryption (P2PE) capabilities in Bluefin’s PCI …

Read More »A Top Visa Official Outlines Four Big Trends Impacting Acquirers

Acquirers and independent sales organizations wanting to improve their standing among merchants should take note of four trends affecting payments today, according to Bill Dobbins, head of acquiring and enablement at Visa Inc. Dobbins, speaking at the Western States Acquirers Association conference in Las Vegas this week, outlined why the …

Read More »Card91’s Digital Prepaid Card and other Digital Transactions News briefs from 9/19/24

Card91, an India-based technology company, introduced a platform that offers a digital prepaid card that also functions as an ID and access card. The product is aimed at corporate employees and students. KM Malta Airlines, a new air carrier, has agreed to adopt a payments-orchestration platform from CellPoint Digital. Online-security firm DefenseStorm said it …

Read More »