Corcentric, a business-to-business payments provider, said it will go public via a merger with North American Merger Corp., a special purpose acquisition company. The company’s network supports more than 450,000 buyers and more than 1.4 million suppliers and processes more than $100 billion in volume annually.Chainalysis, a provider of blockchain …

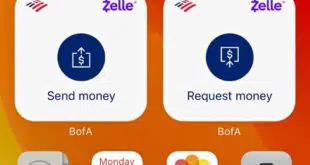

Read More »BofA Introduces a Zelle Widget to Help Veil Account Details for P2P Transfers

To make it more convenient for its customers to send money using Zelle, the major peer-to-peer payment network operated by Early Warning Services LLC, Bank of America Corp. has developed a Zelle widget that can be added on the home screen of a mobile device. The widget will take BofA …

Read More »Eye on Crypto: Visa Launches a Consulting Unit; Nextech Links to Coinbase for Acceptance

With interest in cryptocurrency increasing at the two major card networks, it was only a matter of time before one of them launched a consulting service specializing in the subject. Visa Inc. early Wednesday announced it is launching its Global Crypto Advisory Practice as part of its existing Visa Consulting …

Read More »57% Use App for Takeout Food and other Digital Transactions News briefs from 12/8/21

A report from consulting firm Deloitte found that 57% of consumers use a digital app to order restaurant food for off-premise dining, up from 54% in 2020. Even for ordering in a restaurant, 64% of consumers prefer to place their order digitally, up from 53% last year. The survey of 1,000 consumers …

Read More »With At-Pump EMV a Work in Progress, Providers Look to Mask Card Transactions With Encryption

The switchover of gasoline stations in the United States to the EMV chip card standard has been a work in progress, but now products are emerging that can secure card data at the pump through a technology known as point-to-point encryption. Payments provider ACI Worldwide Inc. early Tuesday said it …

Read More »Stripe Acquires OpenChannel and other Digital Transactions News briefs from 12/7/21

Processor Stripe Inc. said it acquired OpenChannel, which provides app marketplace software. Terms were not disclosed.Payments provider Payoneer Inc. announced a worldwide working-capital offer for sellers on the Walmart U.S. marketplace.In related news, Facepay Inc., a payments provider specializing in auto-repair shops, said its Facepay Capital service is available to all shops on its platform.Money transmitter LianLian …

Read More »Tassat Scores Western Alliance Bank for Its Bank-Based Blockchain-Payment Technology

Stablecoins have come in for government scrutiny in recent weeks, but use of this blockchain-based technology to enable immediate business-to-business payments between bank clients is moving forward nonetheless. Late Thursday, Tassat Group Inc. announced Phoenix-based Western Alliance Bank will use the company’s TassatPay technology to allow business clients to pay …

Read More »Splitit Volume Increases 61% and other Digital Transactions News briefs from 12/3/21

Buy now, pay later specialist Splitit Payments Ltd. said its merchant sales volume for the first two months of the fourth quarter totaled $94 million, a 52% increase quarter-over-quarter and a 61% increase year-over-year. Splitit reported $11 million in merchant sales volume across the holiday shopping weekend, including Black Friday and Cyber …

Read More »Eye On Holiday Fraud: Expect a Surge in Attacks for Higher Dollar Value Items

The holiday-shopping season is a busy time not just for merchants and consumers, but for criminals, too. Fraud attacks are projected to increase by at least 50% this holiday-shopping season, and will most likely surpass the 56% increase in attacks during the 2020 holiday season, according to Arkose Labs. Fraudsters …

Read More »Cart Abandonment Issues Linger and other Digital Transactions News briefs from 12/2/21

Online checkouts remain a challenge for many merchants as 40% report cart abandonment as more than a minor issue and 41% say fraudulent transactions have risen since the pandemic set in, according to Paysafe Ltd.’s “Lost in Transaction” report.PayPal Holdings Inc. said merchants on the Wix.com Ltd. e-commerce platform can offer …

Read More »