Mercari, an online marketplace for second-hand goods, said consumers can use buy now, pay later services from Zip Co., formerly Quadpay, on its Web site.Buy now, pay later specialist Uplift Inc. said consumers who book with Sixthman, a music-festival organizer on cruise ships, can pay for their tickets in monthly installments. Sixthman is …

Read More »Astra Partners With Plaid to Make It Easier for Developers to Add Automated Transfers

As part of its strategy to remove friction from automated bank transfers, Astra Inc., a provider of bank-to-bank transfer technology, is partnering with open-banking platform provider Plaid Inc. The partnership will make it easier for software developers to embed automated bank transfers into their applications by enabling them to use …

Read More »Visa Adopts Contactless Transit Incentive and other Digital Transactions News briefs from 8/30/21

Visa Inc. and JPMorgan Chase & Co. said they will donate a dime to New York Cares through the month of September, up to a limit of $250,000, for each tap riders perform with a Chase Visa contactless card on subways or buses operated by New York City’s Metropolitan Transportation Authority.VPay, …

Read More »The Latest LexisNexis Report Finds the Cost of Fraud Is On The Rise Since the Pandemic Set in

The cost of fraud to merchants has risen since the onset of the Covid-19 pandemic. Each $1 in fraud costs retailers in the United States $3.60 in total expenses, compared to $3.13 pre-pandemic, according to LexisNexis Risk Solutions’ “True Cost of Fraud” study for e-commerce and retail merchants. U.S. e-commerce …

Read More »Installment Payments Arrive for Rent and other Digital Transactions News briefs from 8/24/21

Till Inc., a rental payment provider, announced four new features enabling tenants to pay rent. One, Budget and Save, enables tenants to allocate rent in smaller installments for their entire rent prior to the due date. Landlords still receive the full rent amount on the due date. Another feature, Rewards …

Read More »Mastercard’s Credit Card Fees Find Themselves in the Cross-Hairs of a U.K. Class Action

While the two global payments networks have been embroiled in a controversy over merchant debit card fees in the U.S. market, they also face trouble in the United Kingdom over an even bigger issue: credit card interchange fees. That fact was thrown into relief early Thursday when Reuters reported the …

Read More »Boku M-Payments Network Spans 90 Countries and other Digital Transactions News briefs from 8/19/21

Boku Inc. launched what it says is the world’s largest mobile-payments network. The M1ST Payments Network reaches 5.7 billion mobile-payment accounts in 90 countries and offers more than 330 payment methods, the company says.Global payments provider Adyen NV said Just Eat Takeaway.com, an online food-delivery marketplace, will issue its prefunded Takeaway Pay Card …

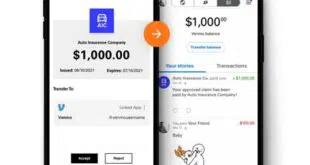

Read More »Fiserv’s Carat Adds PayPal And Venmo As Payout Options

Carat, Fiserv Inc.’s digital payout service, has broadened the number of accounts payments can be sent to with the addition of PayPal Holdings Inc. and Venmo. Carat payouts already can be sent to a credit or debit card, via automated clearing house to a bank account, to a prepaid card, …

Read More »Pulse Debit Study: Online And Contactless Usage Surges While Wallets Assert Themselves

The story of debit cards in the pandemic year of 2020 turns out to have several chapters—including higher average tickets, a sharp swing to card-not-present usage, a dramatic surge in contactless adoption, and higher mobile-wallet usage. Meanwhile, account-to-account transfers turned out to be the fastest-growing form of debit, though usage …

Read More »A 4X Increase in Phishing Attack Costs and other Digital Transactions News briefs from 8/17/21

The overall costs of phishing attacks on businesses have nearly quadrupled since 2015, rising from average losses of $3.8 million per company in 2015 to $14.8 million in 2021, according to research from cybersecurity and compliance company Proofpoint Inc. and Ponemon Institute.Uplift Inc., a buy now, pay later provider specializing in travel, …

Read More »