Drug store chain Walgreens announced it is enabling online SNAP/EBT payment acceptance via Instacart nationwide at more than 7,500 Walgreens stores, including more than 100 Duane Reade stores in New York. Most Walgreens locations already accept SNAP/EBT payments in store. Walgreens also added DoorDash Inc.’s SNAP/EBT acceptance earlier this year. In related news, Instacart also announced …

Read More »Bitcoin Depot Expands Its Merchant Network And Exceeds 8,000 Bitcoin ATMs

Bitcoin Depot Inc. has added more than 1,500 merchants across six more states to its BDCheckout program, which allows consumers to load cash into their Bitcoin Depot wallets at participating merchants. The expansion brings the number of BDCheckout merchants to 7,723 in 31 states. The new states into which Bitcoin …

Read More »Chase Expands Its Partnership With DoorDash to Include Non-Restaurant Merchants

Chase, the banking arm of JPMorgan Chase & Co., has expanded its relationship with third-party delivery service DoorDash Inc. to non-restaurant merchants. The deal will enable Chase Sapphire and other eligible Chase cardholders to receive recurring benefits on orders from more than 150,000 grocery, convenience, and non-restaurant stores in the …

Read More »Helper Bees Pick Lynx for Card Program and other Digital Transactions News briefs from 8/1/24

An in-home services company called The Helper Bees has launched a benefit card that allows members to spend benefits at more than 60,000 retail locations, including drugstores and grocery chains. Duda, a Web site developer, said its e-commerce technology has integrated with Block Inc.’s Square platform, a move it says will allow …

Read More »Mastercard’s Chief Executive Laments a Broken Interchange Deal

Mastercard Inc.’s chief executive early Wednesday deplored the recent collapse of a key interchange settlement and highlighted the card company’s rapid progress in tokenization, a key technology that masks actual card data from potential cyberthieves. Pointing to a U.S. District Court judge’s rejection last month of an agreement between merchants and …

Read More »Aurora’s New POS Terminals and other Digital Transactions News briefs from 7/31/24

Aurora Payments, a payments-technology developer, said it has worked with payments-hardware firm Sunmi and software developer Proxet to introduce a new line of point-of-sale terminals they say is designed for small businesses. The Western Union Co. reported processing 73.3 consumer-money transactions in the second quarter, up 3.8% year-over-year, while revenue in the segment …

Read More »Square Joins US Foods’ Check program and other Digital Transactions News briefs from 7/26/24

Square announced it has joined US Foods’ Check program, which offers technology to restaurants. Square is the point-of-sale payments unit of Block Inc. US Foods is a distributor to the dining industry. China’s UnionPay cards now total more than 240 million outside China, the company said in an update, with issuance in 82 …

Read More »Kasheesh Brings a New Twist to Split Payments

Financial technology provider Kasheesh Inc. on Thursday launched a virtual card that allows consumers to split payments for online purchases across up to five existing credit, debit, and prepaid cards. The card is intended to provide an alternative to buy now, pay later loans. The Mastercard-branded card can be loaded …

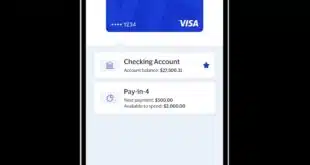

Read More »Card Issuer Marqeta Will Support Visa’s Flexible Credential

Marqeta Inc. early Thursday said it has become the first card-issuing platform to adopt technology announced earlier this year by Visa Inc. that lets cardholders toggle among a variety of payment methods for a single card rather than be restricted to the payment type indicated by the card itself. Oakland, …

Read More »Fiserv Racks up Growth Via Strength in Merchant Services

Fiserv Inc.’s top brass early Wednesday celebrated a second quarter in which adjusted revenue jumped 7% and adjusted earnings per share grew 18%, but it was new programs and alliances—including one with Apple Inc.—that took center stage as the company presented its second-quarter results. Cash Flow Central, a banking alliance …

Read More »