The bank-sponsored Zelle person-to-person payment service continued on its growth trajectory in the first quarter, with transaction volume up more than 70% and payment volume rising more than 50%. Zelle provider Early Warning Services LLC reported Wednesday that first-quarter payment volume hit $39 billion, a 54% increase from just over …

Read More »KeyBank Issuing Contactless Cards and other Digital Transactions News briefs from 4/24/19

KeyBank said it has begun issuing contactless-enabled Mastercard credit and debit cards. Diebold Nixdorf Inc. said KeyBank will upgrade its network of 1,400 ATMs with Diebold’s DN Vynamic portfolio of software applications that includes ATM management and more options for customers, including selection of bill denominations. Payments provider CCBill LLC announced …

Read More »How an Old Standard Could Trip Up a New Generation of Contactless Payments

The surprising revelation by J.C. Penney Co. Inc. over the weekend that it had ceased acceptance of contactless payments unmasked the little-noticed ability of contactless mobile wallets to work with point-of-sale technology that far predates them but which Visa Inc. wants banished. The blend of old and new has worked …

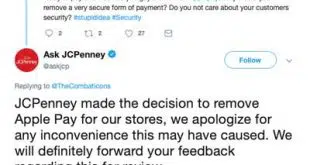

Read More »JCPenney Drops Apple Pay

Department-store chain J.C. Penney Co. Inc. confirmed over the weekend that it no longer accepts Apple Inc.’s Apple Pay mobile-payment service. The move appears to involve a Visa Inc. contactless rule that took effect this month that may have broader implications for U.S. retailers. The confirmation came in a tweet …

Read More »Visa Next Promises Greater Consumer Control of Digital Payments

Visa Inc. announced Monday the debut of Visa Next, a platform for issuers and issuer-processors that enables such options as the ability to create new digital card accounts on demand and instantly activate and tokenize digital accounts for e-commerce and mobile-wallet use. Visa Next offers a series of application programming …

Read More »First Data in Joint Venture To Buy Ireland’s Payzone and other Digital Transactions News Briefs from 4/19/19

Allied Irish Banks p.l.c. and processor First Data Corp. formed a joint venture to acquire a 96% stake in Payzone, operator of Ireland’s largest retail payment network, for about €100 million ($112.5 million) including debt. AIB will own 75% of the joint venture and First Data 25%, according to The Irish …

Read More »Bad Bots Favor Financial Services, Report Finds

Being Number 1 when it comes to malicious online bot traffic is not the highest praise for the financial-services industry. But, that’s where the industry stands in the “2019 Bad Bot Report: The Bot Arms Race Continues,” released Wednesday by Distil Networks. Of the traffic tracked in the report, 42.2% …

Read More »In a Return to Mobile Financial Services, T-Mobile Launches Its Money App Nationally

In a sign that at least some U.S. wireless carriers haven’t given up on their ambitions in mobile payments, T-Mobile US Inc. on Thursday launched its T-Mobile Money service nationwide. But the service, which began as a pilot in November, goes beyond payments offerings to include some traditional banking services …

Read More »AmEx Card Volume up 7% and other Digital Transactions News briefs from 4/18/19

American Express Co. reported first-quarter U.S. card-billed business of $195.5 billion, up 7% year-over-year. International volume slipped 1% to $100.2 billion, bringing AmEx’s total billed business to $295.7 billion, a 4% increase from $283.8 billion a year earlier. Discount revenue rose 5% to $6.2 billion. AmEx said its average worldwide …

Read More »Bank of America’s Zelle Transaction Volume More Than Doubled in the First Quarter

The Zelle person-to-person payments service continues to boom for one of its biggest participants, Bank of America Corp., where transaction volume more than doubled in the first quarter. BofA reported Tuesday that its customers sent or received 58.1 million Zelle transactions via email addresses or mobile-phone numbers, up 103% from …

Read More »