Point-of-sale system maker Lightspeed debuted Lightspeed Payments, a service for in-store and e-commerce payments. The service unifies a merchant’s card-present and card-not-present transaction data into one reporting location within the Lightspeed POS software. Regardless of the card type, merchants pay 2.6% plus 10 cents per card-present payment and 2.6% plus …

Read More »Visa Eyes More Contactless Cards And More Volume From Visa Direct

Visa Inc. saw payment volume growth of nearly 11% in the quarter ended Dec. 31, and sees ever-more contactless cards and volume on its Visa Direct real-time payments service in its future. Visa on Wednesday reported a respectable first quarter of fiscal 2019, according to its chief executive, despite the …

Read More »Apple Pay Volume Exceeds 1.8 Billion and other Digital Transactions News briefs from 1/30/19

Apple Pay processed more than 1.8 billion transactions in fiscal 2019’s first quarter ended Dec. 31, “well over twice the volume” of the year-earlier quarter, Apple Inc. CEO Tim Cook told analysts late Tuesday, according to a SeekingAlpha.com call transcript. Apple Pay is now live in 27 countries, most recently …

Read More »TSYS Sets ‘Aggressive Goals’ for Vital But Predicts ‘Headwinds’ From the CFPB’s Prepaid Rule

Top executives at Total System Services Inc. on Tuesday predicted big results from the Columbus, Ga.-based processor’s new Vital line of point-of-sale payment devices but also warned the onset of a massive federal regulation this spring will crimp prepaid card revenues in 2019. They also assured analysts on a conference …

Read More »Data Breaches Fell in 2018, But Records Exposed More Than Doubled, Non-Profit Reports

The number of known data breaches fell 24% in 2018, but the number of compromised records that contained sensitive personally identifiable information more than doubled from 2017’s levels to over 450 million, according to the Identity Theft Resource Center’s latest annual data-breach review. The San Diego-based non-profit and partner CyberScout …

Read More »Only 14% Use Mobile Payments and other Digital Transactions News briefs from 1/29/19

Just 14% of U.S. smart-phone users are using mobile-payments services from smart-phone makers, such as Apple Pay from Apple Inc., according to a survey from Juniper Research, which says “the window of opportunity in the U.S. for mobile-payment providers like Apple Pay and Google Pay is closing fast.” The survey …

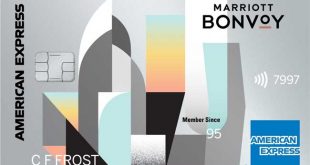

Read More »A New Marriott Card Lineup Lets AmEx Launch a Contactless Expansion

When JPMorgan Chase & Co. announced in November it would soon start mass-issuing contactless Visa cards, industry experts expected the move to at last kickstart a trend in the U.S. payments industry toward tap-and-pay EMV plastic. But while most experts thought Chase’s decision might stir smaller banks to follow suit, …

Read More »Discover’s Contactless Fitness Improves Through Its Link-Up With Garmin Pay

Holders of Discover cards can now add their cards to the Garmin Pay mobile wallet for Garmin International Inc. wearable devices to make contactless payments, Discover Financial Services and Garmin announced Monday. Today’s announcement means that Discover is joining Visa and Mastercard as a payment option for Garmin Pay wallet …

Read More »Chase Adds Another Contactless Card and other Digital Transactions News briefs from 1/23/19

JPMorgan Chase & Co.’s Chase credit card unit and the Marriott International Inc. hotel chain introduced a contactless cobranded card, the Marriott Bonvoy Boundless card, to replace the Marriott Rewards Premier Plus card. American Express Co. announced the rebranding of its current portfolio of cards for customers of Marriott International Inc.’s …

Read More »Target, Taco Bell, And Other Chains Are the Latest to Sign up for Apple Pay

Apple Inc. on Tuesday announced Target Corp., Taco Bell, and two regional chains are the latest merchants to agree to accept Apple Pay in-store, a development that could bolster the mobile-payments service and further smooth the road for contactless payments in the United States. Separately, Target announced it will also …

Read More »