With the judge in the massive credit card interchange litigation apparently insisting on a trial, a new and unsettling element of uncertainty now hangs over the nearly 20-year-old case, in which merchants allege anti-competitive behavior by the big credit card networks in setting interchange fees. The latest development comes nearly …

Read More »Looking to Snag Millennials and Gen Zers, eBay Adds Venmo

EBay Inc. is recruiting Venmo as a payment option, the big e-commerce marketplace announced early Thursday. The move, which comes about a week after eBay announced it will no longer accept American Express cards effective Aug. 17, is part of a strategy to add alternative payment options that appeal to …

Read More »Men Are Now the Primary Buyers of Gift Cards, Blackhawk Network Finds

Men have supplanted women as the primary buyers of gift cards, says a report from Blackhawk Network. The shift is attributable to men taking on more household responsibilities, such as shopping and gifting, the report says. Blackhawk has been conducting the survey for nearly a decade. Types of gift cards …

Read More »Dash’s Visa Real-Time Deal and other Digital Transactions News briefs from 6/12/24

Payments platform Dash Solutions has expanded an agreement with Visa Inc. to include a capability for Dash users to send real-time payments to cards, bank accounts, and mobile wallets using Visa Direct, Visa’s faster-payments platform. The payments fintech Bread Financial said its Comenity Capital Bank will issue Saks Fifth Avenue’s World Elite Mastercard and …

Read More »Entrust Launches Digital Identity Verification for Government Benefits And Services

Entrust Corp., a provider of identity technology, on Monday launched its Citizen Identity Orchestration platform, which is aimed at governments’ delivery of public services. The new platform, intended for such functions as benefits delivery, tax filing, health-care access, and border crossings, uses artificial intelligence for identity verification, issuance of digital …

Read More »Maverick’s Visa Integration and other Digital Transactions News briefs from 6/10/24

Maverick Payments said it is working with Visa Inc. to offer direct acquiring capability on the Visa Acceptance Platform. The new connection, expected to go live in the third quarter, will let Maverick resellers and merchants gain access to a direct link to VisaNet. Google Inc. has discontinued GPay, or Google Pay, …

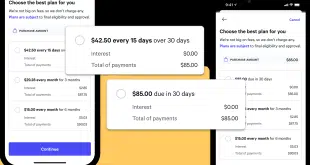

Read More »Affirm Adds New Payment Options And Partners to Attract Omnichannel Merchants

Buy now, pay later provider Affirm Holdings Inc. has expanded its payment options to include Pay in 2 and Pay in 30. The new BNPL options are intended to provide consumers with more flexibility in budgeting their monthly income, the company says. Data from the Bureau of Labor Statistics shows …

Read More »Canadian Customers Are Losing Enthusiasm for Credit Card And Banking Apps And Sites

Banks and credit card companies have launched online services and mobile apps over the years to reinforce ties to their most valuable customers and win new ones. But, in Canada at least, that effort is hitting a brick wall, a series of new reports from J.D. Power indicates. While Canadian …

Read More »The Best Tipping State and other Digital Transactions News briefs from 6/6/24

Toast Inc., a provider of pay-at-table payments devices for the hospitality market, reported data derived from 112,000 restaurant locations in its Q1 2024 Restaurant Trends Report. Among the results: Tipping is most generous in Delaware, where it averages 22.1% of the bill. Mastercard Inc. said it is integrating Deposit Switch and …

Read More »Is eBay’s Decision to Drop AmEx a Ploy To Negotiate Lower Acceptance Costs?

EBay Inc.’s decision to stop accepting American Express cards effective Aug. 17 is generating big headlines, but some payments-industry experts question whether the decision is really a tactic to negotiate a lower interchange rate from the travel-and-entertainment card giant, given that eBay says it won’t stop accepting AmEx for about …

Read More »