Fiserv Inc., already a behemoth in merchant processing, is preparing to straddle its twin pillars of acquiring-bank relationships, on the one hand, and its own acquiring operations through a Georgia bank charter, on the other. The charter, which the big processor applied for last month, has “a very specific purpose,” …

Read More »Affinipay’s Tap-to-Pay Play And Other Digital Transactions News briefs from 2/6/24

AffiniPay, a specialist in payments for professional offices, launched a refreshed version of its In-Person-Payments service featuring new payments devices that include tap-to-pay functionality. Fiserv Inc.’s Small Business Index for January remained unchanged from December at 138. Year-over-year sales grew 1.7%, down from December’s 2.6% rate. The Index, introduced in January, measures …

Read More »Fleet Card Startup AtoB Signs an Exclusive Network Deal With Mastercard

AtoB, a 4-year-old payments platform for the trucking industry, announced Monday that Mastercard Inc. will be the exclusive network for its commercial card program. AtoB’s platform provides such tools as fleet cards, direct-deposit payroll, and access to bank accounts. The San Francisco-based fintech’s fuel card offers discounts of up to …

Read More »PayRange Licensing Victor And Other Digital Transactions News briefs from 1/31/24

KioSoft Technologies has agreed to license technology from PayRange Inc. in a deal that could exceed $62 million in value over a 10-year period. The agreement stems from a settlement of a four-year dispute in which PayRange, a provider of payments technology for the laundry and vending industries, alleged KioSoft infringed its …

Read More »Amazon Adds BNPL in Mexico And Recruits SellersFi for Amazon Seller Financing

Amazon.com Inc. is offering buy now, pay later loans in Mexico through a partnership with Kueski Pay, a BNPL program in Mexico. Shoppers on Amazon Mexico can use Kueski Pay to pay for their purchases in four or 12 bi-weekly installments through a linked bank account or debit card, or …

Read More »AmEx Posts Strong Numbers As It Looks to Add Card Features And Cardholders

American Express Co. reported record revenue and record earnings early Friday as it posted a fourth-quarter 2023 performance that the company says proves it has put the languor of the pandemic behind it. “Looking back over two years, we have achieved what we set out to do. We are a …

Read More »Visa Revenue up 9% And Other Digital Transactions News briefs from 1/26/24

Visa Inc. reported $8.6 billion in net revenue for its December quarter, up 9% year-over-year, on $3.9 billion in credit and debit card volume, up 7.8%. Apple Inc. announced changes to iOS, Safari, and its App Store to meet European Union rules, including new options on its App Store to use payment …

Read More »Mastercard Tags Biometrics And Passkeys as a Fix for Passwords

Mastercard Inc. is taking on the problematic use of passwords with its new Biometric Authentication Service. Announced Wednesday, the new global service is meant to help resolve friction and vulnerability issues that arise from ceaseless passwords and multi-factor authentication prompts, Mastercard says. The service relies on standards from the Fast …

Read More »Worldpay’s Gateway Ranking And Other Digital Transactions News briefs from 1/25/24

Payments research and consultancy firm TSG conferred its Best Performing Gateway award on Worldpay, with Elavon’s Fusebox in second place. The firm monitors gateway performance through its Global Experience Monitoring platform, which monitors credit card transactions across 30 locations around the world. Digital workflow provider ServiceNow announced a five-year agreement with Visa Inc. to …

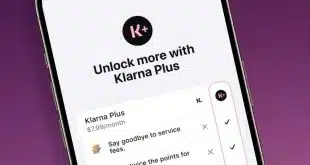

Read More »Eye on BNPL: Klarna Debuts a Subscription Service; PublicSquare Enlists Credova

Klarna AB, a buy now, pay later provider, is entering the subscription arena with the U.S. launch of Klarna Plus. For $7.99 a month, Klarna Plus enables eligible consumers to earn double rewards points on their purchases, pay no service fee when using Klarna at merchants outside of the Klarna …

Read More »