Point-of-sale technology provider Adyen NV has added Tap to Pay on Android, which allows merchants to accept contactless card payments directly on a mobile device with no additional hardware. Adyen is adding the technology initially in the United States and Singapore. Checkout.com launched Identity Verification, a tool based on artificial intelligence that allows …

Read More »It’s Time for Congress to Dump the CCCA And Modify the Durbin Amendment, a Report Argues

With proposals aimed at controlling merchants’ costs for accepting credit cards having re-emerged in Congress, research has been emerging on both sides of the issue this summer as advocates for sellers and card issuers compete to influence any eventual legislation. The latest thrust appeared Monday with a research report arguing …

Read More »With FedNow’s Launch Just Around The Corner, Pidgin Publishes Real-Time Payments Primer

Real-time payments platform provider Pidgin Inc. has published an eBook detailing key steps financial institutions should be taking to prepare for real time payments. The eBook, published just ahead of the debut of Federal Reserve’s FedNow real-time payments network this month, details how financial institutions can use real-time payments to …

Read More »FIS Gets FedNow Certified; MX Partners With Open Banking Specialist Moneyhub

FIS Inc. is the latest processor to be certified for the Federal Reserve’s FedNow real-time payments network, which is scheduled to launch later this month. FIS, which announced yesterday it is selling a sell a 55% interest in its merchant-processing business, joins a growing list of certified FedNow participants, including ACI …

Read More »Digital Gift Cards Are Poised to Become a $1 Trillion Market by 2032

The global digital gift card market is projected to reach $1.2 trillion in 2032, up from $310.1 billion in 2022, according to a report from market research firm Custom Market Insights. In 2023, CMI projects sales of digital gift cards will total $399 billion, a more than 28% year over …

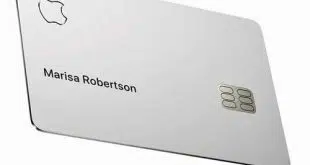

Read More »Why Goldman Sachs Is Looking for the Exit

An overwhelming risk-management burden, coupled with a lack of familiarity with consumer credit, may have triggered the decision at Goldman Sachs Group to negotiate a withdrawal from its agreement to support Apple Inc.’s credit card and its recently launched buy now, pay later service, according to observers. The Wall Street …

Read More »With a Few Weeks Til Launch, FedNow Lists 57 Participants

FedNow, the nation’s second real-time payments network set to debut in late July, says 41 financial institutions, 15 service providers, and the U.S. Department of the Treasury will be ready to send and receive transactions. All 57 have completed certification and testing for FedNow. The Federal Reserve said in 2019 …

Read More »Fed Routing Rule Takes Effect Saturday And Other Digital Transactions News briefs from 6/30/23

On Saturday, a final rule issued in October by the Federal Reserve goes into effect, requiring that all issuers offer a choice of at least two networks for routing online debit card transactions. The update, derived from the 2010 Durbin Amendment, has been a bone of contention for years between merchants and issuers. …

Read More »On the Eve of FedNow, TCH’s RTP Readies for a Real-Time Payments Boom

As the payments industry waits a few more weeks for the expected July launch of the Federal Reserve’s FedNow real-time payments platform, the backer of a real-time payments service that is entering its sixth year readies for more business. Operated by The Clearing House Payments Co. LLC, the Real Time …

Read More »Mastercard’s Subscription Plans And Other Digital Transactions News briefs from 6/29/23

Mastercard Inc., working with Subaio, which offers a subscription management service for banks, launched a subscription control service to make it easier for consumers to identify and unsubscribe from recurring payments via banks’ apps and online access. The move comes after the Federal Trade Commission proposed a rule that would require sellers …

Read More »